Mobile wallet applications have become practical tools for companies, banks, and merchants to expand financial inclusion, increase revenue, and improve the consumer experience in this digital transformation age.

Consumers will soon be able to take advantage of several e-wallet app advantages in everyday life owing to steadily rising smartphone adoption rates. Thus, digital wallet mobile app development is one of the central attributes of fintech app development.

Conventional modes of payment are becoming less popular due to growing interest in digital wallet mobile app development, and many companies now accept online payments for convenience and speedier transactions.

In light of the growth of e-commerce apps and the desire for contactless payments, many digital payment businesses and mobile e-wallet apps have been released. These creative innovations have changed our ability to perform money transactions and given today’s consumers comfort at their fingertips.

According to Statista, digital wallet applications like Apple Pay and Google Pay are anticipated to quadruple in North America between 2020 and 2025. Even so, Asia will continue to have a far broader marketplace.

On the contrary, the adoption of digital wallets like Apple Pay and Google Pay climbed to 89% in 2022 and is forecast to exceed 100% in the future, according to McKinsey & Company 2022 US research. Creating digital wallet software is ideal if you’d like to take advantage of this enormous market.

To increase your offers, regardless of whether you belong to a startup, businessperson, or company owner, let’s explore the realm of eWallet app development in the digital age. This article will walk you through the process, functionality, and pricing of a digital wallet.

Customer Satisfaction & Mobile Wallet Apps

Due to mobile wallet apps, users can now easily make payments, manage their funds, and use services from their cell phones. Users may confidentially keep their payment data via mobile wallet software, avoiding the requirement to carry actual cards or cash. Quick response (QR) and near field communication (NFC) codes make it intuitive and fast to make payments.

According to a Mastercard survey, 76% of customers feel that mobile wallets provide a safer means of payment than conventional ones. Additionally, PYMNTS found that 51% of Gen Z customers believe that mobile wallets will substitute for most or all of the functions of conventional wallets.

In light of this, offering clients trustworthy digital wallets is the best company growth plan. Users have been waiting for brands to provide them with mobile wallet apps.

Read More: From Idea to Launch- A Complete Guide for Digital Wallet App

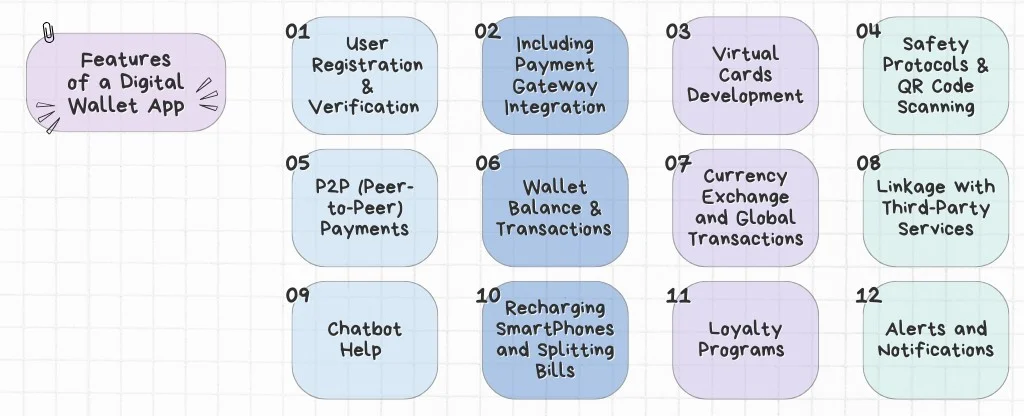

Features of a Digital Wallet App

1. User Registration & Verification

With this feature, customers can set up accounts in the mobile wallet app. Customers can log in using their private data and generate secure login information. Authentication methods like username/password or biometric authentication (fingerprint, face recognition) guarantee that only authorized consumers can log in to their eWallet accounts.

2. Including Payment Gateway Integration

Users of mobile wallet applications that connect to safe and reliable payment methods may connect their financial institutions or credit/debit cards to the apps. The connection increases payment options and makes for smoother, more secure payments.

3. Virtual Cards Development

With the assistance of multiple mobile wallet apps, users may generate virtual cards. These cards add a degree of protection by enabling online purchases. Users can generate an exclusive card number for each purchase, reducing the likelihood of card fraud.

4. Safety Protocols & QR Code Scanning

Mobile wallet apps place a high focus on consumer confidentiality. They have robust safety protocols such as data encryption, reliable authorization methods, and transaction validation procedures to protect customer details and prevent scams.

Employing the QR code scanning feature, users may make payments quickly and easily. Buyers don’t need to manually enter their credit card information by scanning QR codes while paying in person or at an offline shop.

5. P2P (Peer-to-Peer) Payments

One of the most popular functions of digital wallets is P2P payments, which enable customers to transfer and receive money from/to their contacts straight from their eWallets. This function is beneficial for dividing costs or compensating buddies.

Among the most frequently cited instances in this area is PayPal, which is used by millions of users to conduct transactions for both personal and business purposes, including paying for outsourcing, etc.

6. Wallet Balance & Transactions

Customers may check their current wallet status within the app. The transaction record feature thoroughly records every previous exchange, including the date and time, recipient, and quantity. Customers may monitor their expenditures while keeping note of their monetary habits.

7. Currency Exchange and Global Transactions

Mobile wallet apps in use today provide currency exchange and payments abroad. Users may pay in different currencies, and the app simplifies cash exchange. We have successfully integrated NAFEX – Western Union as a part of cross-border and international currency transactions, serving more than 200 nations globally.

8. Linkage with Third-Party Services

Mobile wallet apps may interface with third-party businesses, including doctor appointment booking apps, food delivery apps, and taxi dispatch apps. Customers may pay for services straight from their mobile wallets with this connection, making it easier and improving the user experience.

9. Chatbot Help

Some mobile wallet apps include chatbots to provide consumers with automated help. Chatbot Banking can respond to common queries, provide information about accounts or activities, and provide specific suggestions, enhancing the overall user experience and providing quick customer assistance.

10. Recharging SmartPhones and Splitting Bills

Mobile wallet apps typically provide the option to recharge mobile phone accounts immediately. Users may effortlessly add more credit to their prepaid or postpaid cell accounts. Consumers can divide costs with colleagues or friends using bill-splitting features, simplifying group transactions.

11. Loyalty Programs

The enticing feature of your eWallet is its benefits and vouchers, which attract customers to utilize it for most of their banking activities. This results in higher loyalty and retention rates.

Integrating a loyalty program into the fintech app developed helps improve the customer experience and overall effectiveness of your e-wallet. There is a massive benefit to integrating customer loyalty systems into fintech solutions like digital wallets.

12. Alerts and Notifications

Customers are informed in real-time of important events such as successfully processed payment declarations, account usage, or security-relevant data. These alerts keep customers updated by alerting them to unexpected behavior and enhancing safety.

Cost for Developing a Digital Wallet Mobile App

The cost of creating a digital wallet app relies on many elements, including the mobile OS, the functionalities of the program, the length of the fintech app development process and stages involved, the developer’s setting, the platform used for the application, the company’s strategy, and others.

Thus, it is strongly advised that you first review the project plan and list of primary attributes of the digital wallet development business to obtain an accurate estimate of the cost of product development. However, to provide you with a clearer understanding of what goes into the price of developing digital wallet software, below is a complete list of relevant determinants:

- The system or smart device that you wish to create an application for

- Application sophistication and key aspects

- Competence and experience of the developer

- Cost of UI/UX design

- Costs of technology and hosting

- Your desired number of screens

- App evaluation, upkeep and support following app launch

- Location, personnel size, and taxes of the developer

However, creating an Android digital wallet costs between $20,000 and $50,000. On the contrary, hiring a developer to develop mobile wallet apps for iOS costs between $30,000 and $60,000. These figures give a general idea of wallet app development costs; however, they might go up depending on the characteristics and functions you want to include.

Conclusion

eWallets tranformed the industry, which provide considerably speedier and more manageable payment options. This could be the ideal time to purchase ideas for digital wallet mobile app development since this sector is predicted to expand.

Developing a mobile wallet app involves various steps and processes, from the first app idea to the first functional version. It takes thoughtful preparation, solid backend programming, and flawless front-end execution to create an eWallet mobile app.

If you need expert help developing an eWallet app, Mindster is an outstanding mobile app development company offering a wide range of services. Our crew of talented developers has the skills and expertise to provide excellent eWallet software solutions customized to your unique needs. We can fulfil your requirements if you need cross-platform or native app development.

Feel free to contact us if you’d like to use our eWallet app development services or join with specialized developers for your project. Contact us now to explore your fintech app development requirements and start your successful eWallet app journey.

Ankitha is a professional content writer with more than four years of experience. She writes blogs relevant to the services that we provide and also about the various mobile app solutions that we provide. With strong research skills and critical thinking skills, she can develop high-quality content that is valid and authentic. She also has good communication skills to interact with the team members to build up-to-date content related to the latest technologies.