The Rise of Chatbot Banking: Understanding its Potential

10 Aug 23

How often do you conduct your banking at banking branches? Not very frequently. The growing number of robotic technologies is still going strong, and artificial intelligence is starting to take center stage in banking customer service. This is mainly due to the digital transformation that is happening globally. One instance is the development of chatbot banking.

Have a quick look into our blog reading how AI has improved digital transformation:

The banking sector has yet to be at the forefront of implementing innovative technology that enhances internal operations and client interaction. Banks are putting more emphasis on helping customers with their finances. They are being more creative and utilizing new technologies to meet client demands. As the popularity of digital banking services has grown, so have the needs of consumers, and novel innovations, including artificial intelligence, have emerged to meet those requirements.

Artificial intelligence (AI) has fueled a decade of incredible development and innovation in the fintech sector. This data array is programmed to autonomously carry out a repeated activity with a specific anticipated effect. One of the AI-powered technologies that Fintech apps utilize is banking chatbots.

Chatbots use machine learning and artificial intelligence methods in the banking sector to allow for user conversation and functionality. This enables users to interact with them as though a different individual were available to address any queries.

Chatbot Banking: What Are They?

Artificial intelligence (AI)-powered computer programs called chatbots replicate user discussions while offering prompt and practical support. Chatbots can completely change how clients engage with their bank accounts in the banking sector.

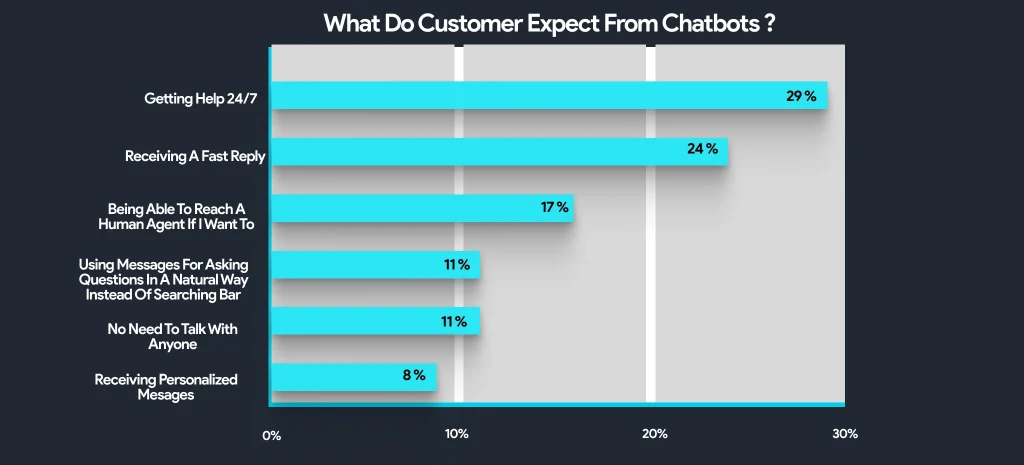

By providing a personalized customer encounter and assisting banks in managing and processing payments more effectively, chatbots have the potential to change the banking sector completely. AI chat agents may handle as much as 80% of typical customer service duties, such as responding to demands for previous transactions or account status information.

The banking industry may drastically enhance its relationships and meet changing client demands by implementing chatbots. The digital transformation in the banking industry has exceeded expectations, giving more space for digital disruption to happen within the industry. A great initial point of contact for standard banking operations is a chatbot.

If a consumer has an issue attempting to send or transfer funds, they require immediate assistance. They prefer to answer the other end of the telephone immediately. Chatbots are equally as capable as counselors at handling this straightforward issue. An AI chatbot banking system could automate many exhausting, repetitive questions. The effectiveness of the department is significantly impacted.

Currently, banks are moving towards using chatbots to streamline the banking process for clients. Banks require reliable systems to ensure these deliverables and give customers prompt support if necessary to achieve this goal.

- Submit more requests

- Money transfers

- Account balance checks

They want sophisticated networks to communicate with these clients and comprehend what they are trying to convey. They require sophisticated chatbots.

Potential Use Cases of Chatbot Banking

Humans’ lives are becoming more accessible with the advent of chatbots. Today, they can help us with practically anything as a result of the way they’ve been created. It wouldn’t be incorrect to say it can be your mentor, friend, and philosopher. Chatbots leave traces of their presence behind them all around us. Some of them are complicated enough to amaze even a computer-aware person with their features, even though many are straightforward in their design.

Bettering the customer journey is the primary goal of chatbots in banking. Numerous approaches exist for artificial intelligence to help clients. Automating dull, repetitive activities is the most frequent application of chatbots in banking customer care. Let’s now examine some potential chatbot applications or advantages for the banking sector.

1. Customer-Centric Services

The foremost use case or benefit of using chatbots in the banking industry is to offer more customer-centric services. Chatbots for personal banking may be developed to learn about customers’ wants and provide personalized suggestions according to their purchasing habits and transactional history.

For instance, a chatbot can offer a consumer who frequently holds debt on their existing credit card a credit card with a cheaper interest rate. According to consumer information or their purchasing patterns, it may also forecast what goods the customer would be interested in.

Additionally, you may employ an AI bot to give consumers on-demand customer service and respond to their inquiries regarding account balances. Doing so may increase client happiness and keep clients from switching to rivals that offer superior customer support.

2. Time & Cost-Effective

By assigning more sophisticated customer support concerns to human experts and basic consumer questions to the chatbot, banks that deploy them may save money. Clients can use chatbots as digital fiscal advisors.

Clients may utilize it whenever they want, enabling human agents to focus their time more effectively on other individuals’ inquiries. Because of machine learning, people in the banking sector can rely on AI chatbots to get wiser and handle trickier banking-related duties for clients.

3. Illegal Activity Avoidance

Additionally, chatbots may be used in banking to combat fraud. Both clients and banks may suffer significant financial losses due to fraudulent activity. By tracking and analyzing client behavior and payments in real-time to spot suspect activity, chatbots can aid in the prevention of fraud. Additionally, chatbots may be set up to notify clients of any odd behavior or suspicious transactions.

Chatbots may also help clients identify illegal activity and explain what to do next. Banks may enhance their fraud protection techniques and reduce financial risk using chatbots. Kai, a chatbot from Mastercard, is one example of how it might assist in spotting unusual activity and warning clients of possible fraud actions on their bank accounts.

4. Customer Teaching

Banking items are sometimes difficult to comprehend, and clients need to know where to look for details. Banking institutions can utilize chatbots as a solution to that issue. Consumers may learn more about banking services and products from conversational agents, who can also assist them in finding particular solutions to their inquiries.

An AI-powered chatbot may offer tailored budgeting advice depending on a client’s transactional record and spending patterns. For instance, depending on a consumer’s credit card balance history, a chatbot may offer advice on conserving money or recommend strategies to lower credit card debt. They may also help clients manage their assets and provide financial guidance.

5. Reviews & Comments

If financial institutions take good care of their hard-earned money, customers would be more than happy to provide comments and ratings. The banking chatbots can gather such feedback. Banks may now incorporate chatbots on their web pages and mobile applications to gather feedback and opinions rather than utilizing lengthy survey forms.

Client satisfaction and CSAT ratings can be legitimately improved using this input because the finest marketing resources are a higher CSAT score and a satisfied client. Those are the interactive banking applications that are most often used. Banks may customize their chatbots and utilize them for a better Customer Experience (CX) according to their services and offerings.

6. Reduced Staff Layoffs

When asked the same questions again, individuals become less productive and less satisfied with their work. Because of this, this competent group leaves their position more frequently than other categories the unemployment rate in call centers is between 30% and 45%. Banking chatbots can solve this issue.

The artificial intelligence bot can handle straightforward queries, allowing your staff to work on more complex and complicated activities that increase their drive and productivity. Furthermore, support workers achieve more when managing more challenging financial concerns. Agents who are happy with their work are more efficient and less inclined to leave.

7. Provide Notifications

Maintaining a good credit score, controlling spending, and avoiding late fees are all benefits of paying bills on time. However, some consumers need to pay more attention to the need to provide payments on schedule. Both clients and finance companies need to be improved by this.

By utilizing AI, you can solve the issue. Banking chatbots may notify your clients at the right moment, which will help users remember to pay their debts. By doing this, you may support your clients in handling their money and assist them in forming healthy habits.

Top 5 Banks That Adopted Chatbot Banking

- Bank of America

America’s biggest bank unveiled Erica, a chat-based assistant. The assistant is intended to notify users, provide them with information on their FICO score, point out and acknowledge regions where they could save funds, and pay their payments.

- Capital One

This financial institution unveiled Eno, a written chatbot assistant. A client who uses the artificial assistant can save money.

- Mastercard

Mastercard introduced a chatbot on Facebook Messenger to further its digital offerings. The bots may help consumers evaluate past purchases, spending patterns, and bank balances.

- JPMorgan Chase

To make its back office operations more manageable, the bank offers personal assistants to its clients. By incorporating this, they have been able to save their workers a total of 360,000 hours.

- American Express

The company makes use of Master Card-like technologies. Customers are given situational suggestions, real-time sale announcements, and reminders of credit card perks.

These were only a handful of the banks that used chatbots to provide advantages to their clients. Based on a poll report, 73% of Teenagers anticipate fresh banking offerings from Amazon, Google, PayPal, Apple, or Square. The rising demand indicates that chatbots powered by AI have a promising future.

Future of Chatbot Banking

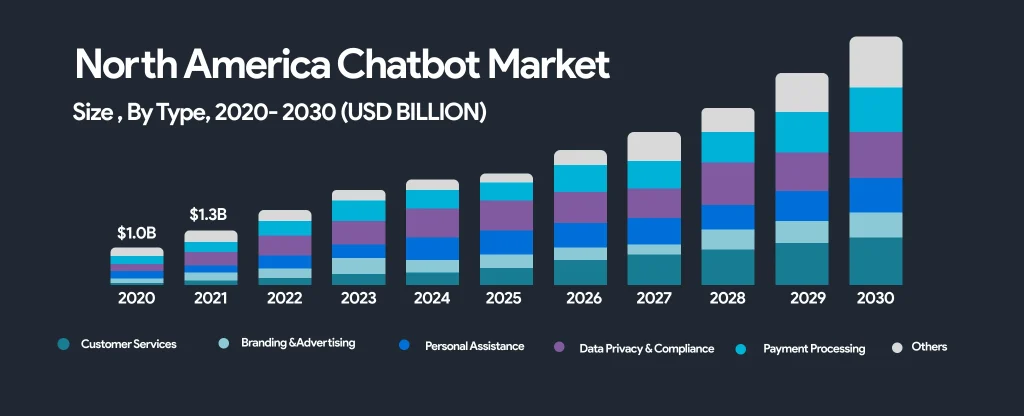

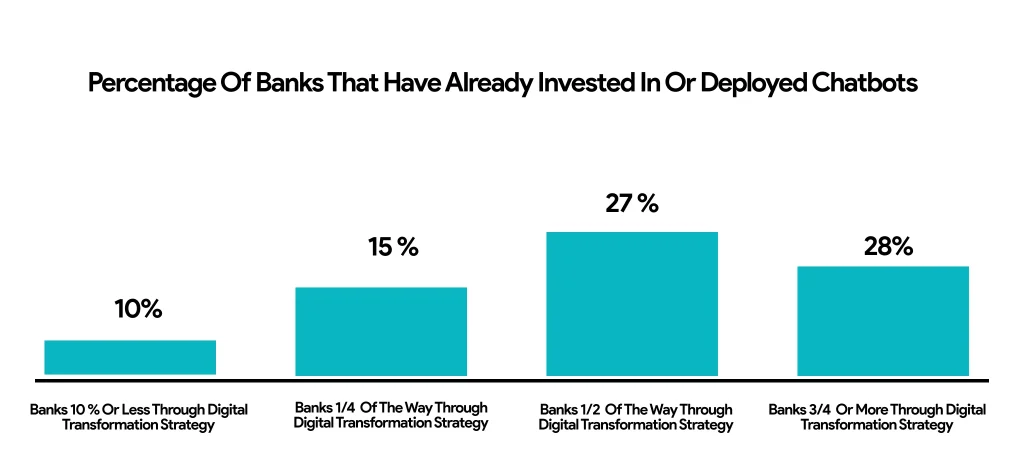

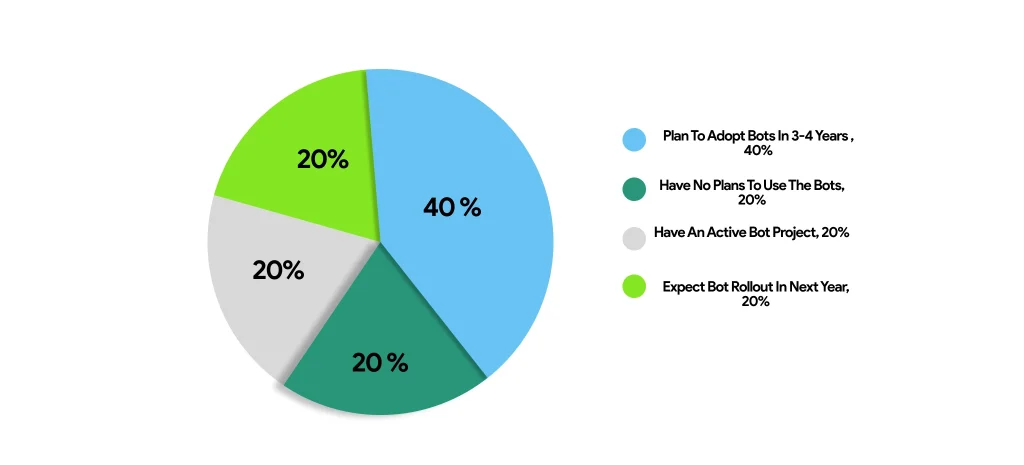

The percentage of banks utilizing AI tools, especially chatbots, is steadily increasing. Another aspect is the fast-expanding tendency to use smartphones and other advanced electronic devices. These two factors determine the immediate future of AI-powered assistants in the finance industry.

Chatbots are becoming increasingly common in fintech app development. This makes it simple for them to keep in contact with their customers while minimizing the need for human staff. According to projections by Juniper Research, chatbot engagements would save banks 862 million hours in 2023, equating to a global cost reduction of $7.3 billion.

In the coming years, chatbot quality will undoubtedly increase. They will understand demands better as they grow more “human,” Chatbots will become more adept at predicting human behavior as a result, and they will utilize this knowledge to continue improving.

Voice assistants will undoubtedly become more prevalent in the upcoming years across all industries, including finance. For instance, they will significantly speed up client communications. The offered capabilities will also expand, leading to new application scenarios for chatbots.

- In 2023, businesses will save $7.3 billion in total costs by using banking chatbots.

- 3150% Increase in productive banking chatbot engagements between 2019 and 2023.

- Bank engagements with chatbots will save them 862 million hours by 2023.

- In 2023, 79% of mobile banking apps’ chatbot engagements were productive.

- Android Development3

- Artificial Intelligence27

- Classified App3

- Custom App Development2

- Digital Transformation11

- Doctor Appointment Booking App13

- Dropshipping1

- Ecommerce Apps38

- Education Apps2

- Fintech-Apps35

- Fitness App2

- Flutter3

- Flutter Apps19

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care7

- IoT2

- Loyalty Programs9

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps120

- Product Engineering5

- Progressive Web Apps1

- Saas Application2

- Shopify7

- Software Development1

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized4

- Web App Development1

Comments