How to Design a Fintech Application: A Step-by-Step Approach

19 Apr 23

The financial technology sector, known as Fintech, is expanding quickly. By 2025, the worldwide Fintech business will be worth $460 billion, contributing to increased Fintech application development.

Thanks to the growth of digital banking, mobile payments, and other Fintech services.

Financial transactions are now quicker, easier, and handier than ever. It is critical to comprehend the procedures and methods if you’re considering producing Fintech software. This post will offer a comprehensive how-to on creating a Fintech app, from conception to release. Whether you’re the CEO of a firm, a product manager, or a developer, this blog will give you the information and resources you need to create a profitable Fintech application.

What is a Fintech App?

Financial services like internet banking, managing investments, budget tools, and electronic payments are offered through a Fintech mobile application.

Fintech applications make use of cutting-edge technology and innovation. They provide people and company owners with a more practical and approachable way of handling economic affairs.

These apps often provide features that include real-time account status, transaction histories, and financial data. They can be utilized via smartphones, tablets, or other mobile devices.

Due to their simple user interfaces, affordable costs, and capacity to help users save time and money, Fintech apps have become progressively more common.

What is Fintech App Development?

Creating a mobile app that offers customers financial services is known as “Fintech application development.”

The goal of developing a Fintech app is to make one that provides a simple and convenient user experience while protecting the safety and confidentiality of users’ financial information.

Fintech Trends

Fintech is, without a doubt, changing how financial services are provided. As a result, businesses in this area have begun anticipating novel approaches in fintech trends that might influence the direction of banking and finance in the future.

- Services and solutions in the Fintech industry are growing in popularity across industries and businesses.

- Due to a high acceptance rate, the goods and amenities are no longer limited to the finance industry alone.

- There is no longer a contactless payment option. They are now the most popular payment options.

- Businesses are discovering new methods to offer customer support as Fintech rediscovers the value of consumer pleasure.

- Client satisfaction is central to everything, from safe payments to 24 hours of access.

- Mobile phone ubiquity and easy technological access have made banking a virtual consumer experience.

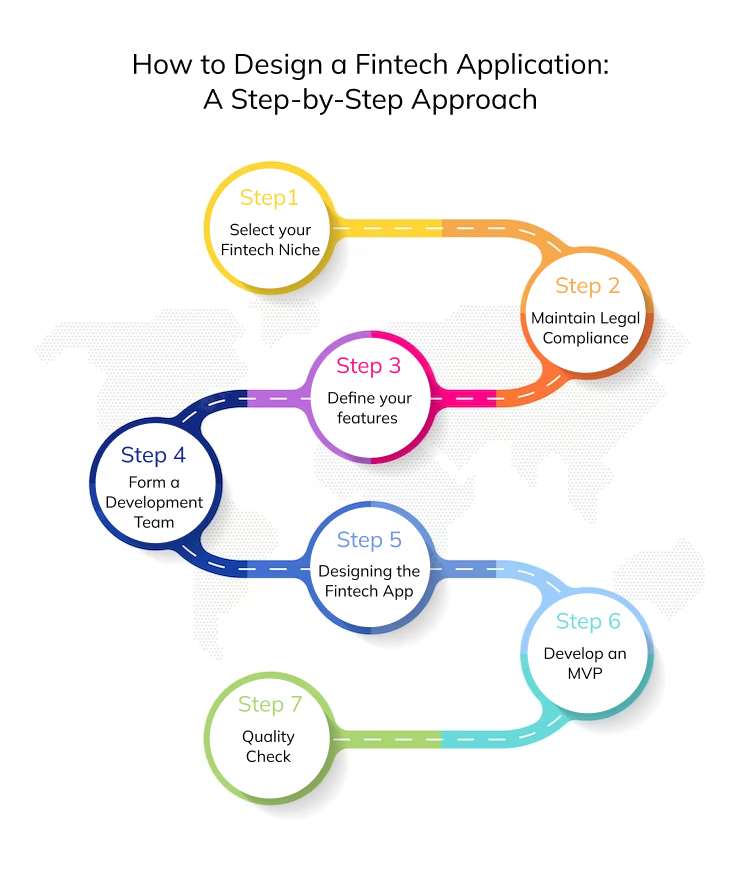

A Structured Plan for Building a Fintech App

The process of developing a Fintech application may be difficult to follow. We have therefore created the most comprehensive step-by-step guide for you to design an effective Fintech app that lives up to expectations and achieves goals.

Fintech Niche

Finding your field of expertise is crucial before starting the development process. It suggests that you should decide what sort of Fintech app you want to create and what area of Fintech you wish to concentrate on.

Alternatively, choose your areas of expertise first, then determine your niche, or look at the features you want in your app, then select your specialty.

When developing a financial app, picking a niche is essential. Therefore, you should first conduct a target market analysis. Afterwards, decide if you want to establish your Fintech solution.

It would be sensible to develop a sophisticated solution if you want to compete. You must stand out among the numerous financial applications, such as budgeting apps. You must legalize your app now that you’ve established a niche.

Maintain Legal Compliance

Following your selection of a niche, ensure your application complies with all applicable laws in the regions where it is essential.

Fintech applications work with fundamental data. Therefore, it is essential to ensure that it complies with the law to assure your clients’ absolute safety and confidentiality.

Legal issues and considerable penalties might result from failing to ensure compliance with the law.

Define Your Features

The type of Fintech app determines its functionality. Examine the demands of your intended audience. You can build a Fintech app on a current platform while thinking about improving it.

Even yet, there are a few similar characteristics to keep in mind:

- High-Security Login: Identification of fingerprints, faces, or voices

- Notifications through Push

- monitoring of spending and savings

- Financial transactions, including money transfers, electronic payments, balance checks, etc.

- Scanning of card numbers and QR codes

- Non-traditional financial services, such as purchasing gift cards or making donations.

Offers, Deals, and Cashbacks

Form a Development Team

In general, outsourcing is the most advantageous and efficient option to developing Fintech apps because you’ll save time and money and receive a team of highly skilled programmers.

In addition, they will respond to all of your questions and satisfy the scope’s predetermined needs.

The size of the team will depend on the scope of the assignment, scheduling, and technology.

For instance, you’ll need Flutter or React Native developers to create a cross-platform Fintech app that works on iOS and Android. Although the development process will take longer, you will simultaneously receive two apps for two separate platforms.

When selecting a team to create your app, consider the company’s finance knowledge, hourly pricing, and development expertise.

Being able to communicate effectively with the project manager is crucial. Hence, language proficiency is necessary.

Designing the Fintech App

The design will draw consumers to your app and keep them engaged. Create an attractive yet straightforward design to ensure a seamless user experience.

Effective UI/UX design is essential for all financial applications. The user will interact with it the most out of all the components. Therefore, ensuring that the app is basic is crucial.

To determine which user interface or user experience matches the application you are developing, it helps to construct several prototypes. Then, after you recruit an experienced crew, this phase won’t be as difficult.

For instance, if you want to create a banking app, avoid creating lengthy forms that users would find difficult to complete while paying bills. Additionally, a choice must be provided for users.

Develop an MVP

Before beginning the complicated development process, it is a good idea to test your notion. A proof of concept with just enough features to permit testing is referred to as a “Minimum Viable Product,” or MVP.

You may employ it to ensure that your Fintech application is effective and useful for customers.

With an MVP, you get early feedback. As a result, it broadens the window for development and minimizes risk factors.

Quality Check

Things continue after your app has launched. First, you must execute an A/B testing stage to examine customer feedback, based on which you will add new cutting-edge features and enhance existing ones.

After being developed, every financial app needs to undergo regular updates and upgrades to guarantee proper operation. Additionally, occasionally upgrades to legal compliance and new functionality can be implemented.

If you want to do better than your rivals, your Fintech app needs to function flawlessly, be safe, and be adaptable for users.

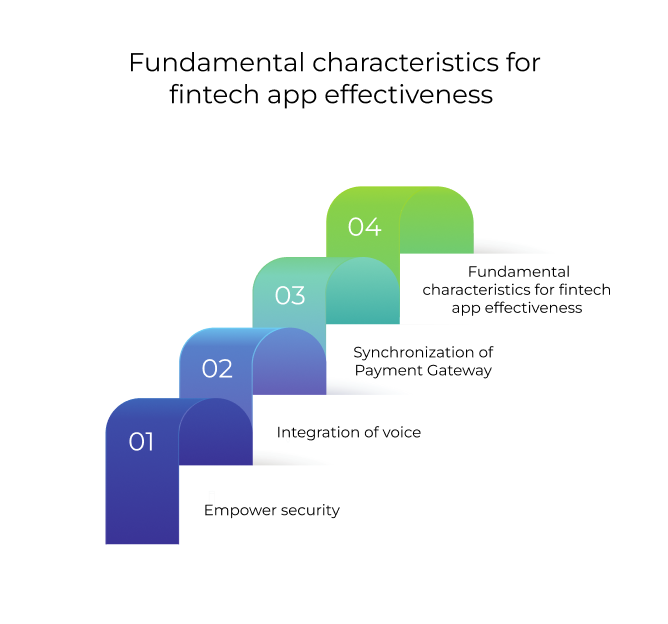

Fundamental Characteristics for Fintech App Effectiveness

Fintech apps are significantly more straightforward to use than traditional banking services.

As a result, it has advantages for overcoming difficulties in Fintech app development, such as setting up a simple payment gateway connection or voice integration. The significant features or characteristics that contribute to the effectiveness of the Fintech apps are given below.

Empower Security

Every Fintech app must adhere to safety standards protecting users’ financial data. A skilled developer of Fintech apps implements security techniques such as two-factor authentication, biometric authentication, blockchain, and encryption to achieve this.

Synchronization of Payment Gateway

The majority of Fintech applications deal with payments. You can link with services like PayPal, Stripe, and Zelle or use bank APIs to make the payment process more accessible.

Dashboards

Create effective dashboards because they are crucial during the financial app development process. It’s difficult to picture someone building Fintech software without an illustration. This is true whether it’s for financial expenditures, payment history, or stock charts.

Integration of Voice

Fintech applications must provide users with contemporary features, which include voice assistants like Siri, Google Assistant, and Bixby. The development of Fintech mobile apps has this as its best feature.

Wrapping Up

Undoubtedly, the current environment offers a fantastic chance to develop top-notch financial solutions.

Do you intend to capitalize on the opportunity and create a reliable Fintech solution for your business?

If so, please contact us. The driven and motivated team members can assist you in creating a successful financial app that will address your company’s concerns and provide your customers with a fantastic experience.

We are a well-regarded mobile app development company with significant expertise in creating unique digital success stories for various businesses.

- Android Development3

- Artificial Intelligence27

- Classified App3

- Custom App Development2

- Digital Transformation11

- Doctor Appointment Booking App13

- Dropshipping1

- Ecommerce Apps38

- Education Apps2

- Fintech-Apps35

- Fitness App2

- Flutter3

- Flutter Apps19

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care7

- IoT2

- Loyalty Programs9

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps120

- Product Engineering5

- Progressive Web Apps1

- Saas Application2

- Shopify7

- Software Development1

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized4

- Web App Development1

Comments