10 Best Payment Gateways You Should Integrate for your eCommerce to Succeed

16 Jul 19

Having the best payment gateway for your eCommerce business can be the most valuable tool to succeed. It should be designed as per your requirements. It helps you to offer a single, integrated solution for point of sale (POS) and processing the payment, which can be offered to merchants as a substitution of the present payment methods.

To ensure that merchants do not compromise with their current provider, your payment gateway solution must be secured to eliminate the danger of chargebacks, and have a more wide scope of choices for making the payments. It even offers focused expenses, end-to-end customer support, quicker settlement, and excellent reporting.

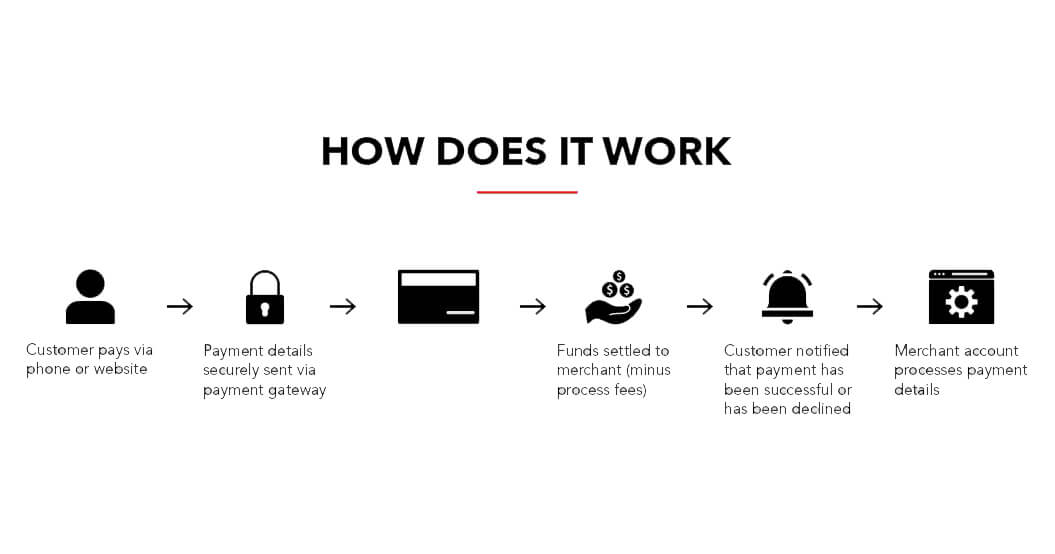

How Do Payment Gateways Function?

Payment gateways are introduced to make the processing of payment successful, secure, and hassle-free. The following are the steps indicating how popular payment gateways in India function:

1. It begins working as soon as customer puts an order request on an eCommerce app or website and fills their credit card credentials.

2. The web browser encodes the information to be sent between it and the merchant’s web server.

3. The payment gateway then sends the transaction data to the payment processor employed by the vendor’s acquiring bank.

4. The payment processor sends the transaction information to a card affiliation.

5. The credit card’s issuing bank sees the request for approval and “approves” or “denies” it.

6. Then the processor forwards an approval related to the merchant and customer to the payment gateway.

7. When the gateway procures this reaction, it transmits it to the site/interface to process the payment.

8. Clearing Transactions is done once the transaction is completed by the merchant.

9. The issuing bank changes the “auth-hold” to a debit, allowing a “settlement” with the vendor’s securing bank.

Consider these Factors

Before you settle on a decision to pick the best payment gateway for your eCommerce business, then you must consider these factors:

- Look at the transition fee related to the payment gateway. Guarantee that it falls within your budget.

- Don’t go for a payment gateway where you need to go through the sign-up process repeatedly.

- If you wish to succeed and become a pioneer in eCommerce, then you have to expand your eCommerce business worldwide. Search for a payment gateway that goes with multi-currency support.

- To know what products you can sell, look at the terms and condition of the payment gateway since some may permit to offer only physical goods.

- Check if your payment gateway supports Mastercard, credit card or PayPal payments.

- Assure that the users do not require your customers to fill optional fields.

Payment Gateway solution accomplishes numerous important tasks in online purchasing and transaction management. Rather than just transmitting the payments, a payment gateway approves the fund that is transferred to the seller, and do as such in a safe and secure path for the purchaser. Payment gateway even considers PCI compliance standards, presenting a bunch of security techniques, to avoid fraudulent practices.

While choosing your payment gateway, ensure it meets all the prerequisites of your business and relies upon specialists’ suggestions depending upon the feedbacks and reviews.

Explained below are the top 10 payment gateways in India that we recommend to suit your business requirements:

1. PayU

PayU, developed by the Indian payment-processing corporation, is the simplest eCommerce payment system designed to fill the gaps left by various complex service providers. PayU is widely accepted due to its high conversion rates and acceptance over several other payment methods. The PayuBiz’ API’s and SDKs help connect this platform to any site, app, or related 3rd party systems.

PayU allows payment with a single tap. A significant technical advancement is made by permitting the repeat customers to skip the step of entering CVV repeatedly. The platform even allows reading and entering OTP in front of the customers, and complies to the highest of PCI and DSS standards to ensure payment information. It also stores all credit vault data, so that neither the merchant nor their customers would need to key it more than once.

2. Braintree

Introduced in the year 2012, and currently the best mobile payment gateway in India and also over other countries. Financed by venture capitalist and investors, Braintree is diverse in its programming, and the code can be set specifically into a merchant’s online site. It provides a safe checkout experience to the users, thus encouraging them to return to the website. It is an ideal gateway for organizations looking to process payments efficiently and upgrade their order management.

It is presently ready to develop into traditional eCommerce sites that permit the exchange of items or services. It offers an online payment gateway to new and emerging organizations that enables them to address organizations that might not have the ability to manage the payment structure.

Also Read

10 Best payment app gateways you should integrate for your e-commerce to succeed

3. Amazon Payments

Amazon gives a safe and streamlined payment service for customers. To encourage their online purchasing, the service is available to both merchants as well as the customer. It totally works on the information that is already inserted by the customer in their Amazon account to finish registration and checkouts. Using a single login, the customer is instantly recognized and permitted to complete the transaction either through a web or mobile.

Amazon offers no extra charges for their exceptional features; this makes the transaction 100% secure. Like the most payment gateways, clients are charged a fixed amount for the transaction. Amazon payments can be made in different languages and support every currency to reach even the international audience.

4. OrangePay

OrangePay is an ideal platform for conducting difficult tasks, as it can offer you comfort and decrease the risks by ensuring consistency with laws while offering confirmation from fraudulent transactions through different secured tools. OrangePay reduces the risk of rebelliousness for various approaches. Similarly, it includes SSL-encryption and 3D security to secure your private data.

This payment gateway solution offers great comfort to users by supporting an immense selection of favorite payment channels including VISA or MasterCard, Bitcoin, Qiwi, PayPal, and Krill, and so on. eCommerce Payment options are versatile to suit different industry standards thus making it an ideal choice for handling companies, freelancers etc.

5. Authorize.Net

Built up in 1996 and considered as one of the best payment gateways for eCommerce business. Around 400,000 merchants utilize this through credit cards and electronic checks.

Merchants deal with their account utilizing Authorize. Net’s Merchant Interface. They can set up many accounts of a user to control access for each user. With an additional feature, Authorize.net is a simple win to keep up your online business. Specialists usually recommend this for the Magento stores and eCommerce.

6. Stripe

Launched in 2010, Stripe offers best payment services to merchants. Their extensive set of tools used for developing set them apart from other payment processing suppliers. Stripe is committed to your eCommerce as a capable and versatile API, which empower you to customize the platform according to your necessities. It runs with a prevailing productivity software family that accompanies a set of open API to help you connect it to the rest of your business ecosystem.

It counts several incorporated applications: this implies you are not required to be a specialist in coding – you can start using it instantly. This online payment takes 7 days to process your payment and has no hidden costs.

7. Skrill

Skrill is an exceptionally viable UK-based payment gateway intended for consumers as well as businesses. With the help of Skrill, you can make global transactions, pay for items and services wherever you are with the help of a dedicated mobile app. Dynamic users can submit a request for a prepaid Master card, and utilize it to pull back assets/purchase items wherever they may be.

There are no charges for creating a Skrill account, but there is a fixed charge for the transactions. On the sender’s side, this charge is very small like 1% of the transaction amount, which makes skrill an ideal option for various costly platforms and gateways all around the world. Skrill is easy to connect with any bank account universally and takes good care of the security on your payment information.

Also Read

Developing a mobile wallet application for all types of payments

8. BlueSnap

A dedicated payment gateway for the merchants and retailers, It permits payments for eCommerce, mobile, and web development. One can coordinate it with every best marketplaces and shopping cart platforms with direct payments. Additionally, by integrating a dedicated server, one can even utilize it to create exclusive desktop and mobile applications for SaaS, gaming, invoicing, etc.

The platform helps you upgrade your eCommerce business by supporting various payment types in your mobile wallet app with multiple currencies and languages. It is entirely operable and also active, and interfaces naturally to a worldwide network of procuring banks to ensure the best conversion rates for each client. It is even outstanding for its Subscription Billing Engine, and customers can pay without the difficulty of entering MasterCard or credit/debit card information.

9. PayPal

Established in 1999, for both MasterCard and credit card payments, and is free for purchasers, while merchants need to pay transition fees while utilizing PayPal for Visa payments. This payment gateway does not require any setup costs, gateway fees, or month to month charges.

The benefits are that vendors don’t need to pay once the sale is over. While utilizing PayPal Standard, customers may leave the site to check out and sign into their PayPal account, or they can pay through Credit card or Visa card without signup. PayPal Pro allows merchants to have and modify their whole check out process so that consumers don’t need to leave the site. It additionally accepts credit cards using fax, mail, or telephone.

10. Easebuzz

Easebuzz was established in 2015 and is revolutionizing the SMB sector businesses and E-commerce in India, already serving thousands of merchant. With an advanced technology stack and a core focus on analytics, they offer the best, customizable, scalable and high performing solutions to e-commerce players. Easebuzz has a wide range of API’s and SDKs available to empower any website, 3rd Party system which is easy to integrate. They kept safety and user experience at the top, offering many smart features like automated refunds, split funds, marketplace, advanced invoicing, recurring, customized coupon, and several plug and play solutions.

With analytics powered automation at its core, Easebuzz offers solutions for complex business problems too and understands the importance of “ease of use” and “simplicity of platform” for small businesses. They have gone a step further with several bundled value-added services ranging from providing a free online store to start their business, marketing apps to engage their customer and several apps to retain their customer. Hence making an ideal choice for any type of vendor.

Summarizing

Payment Gateways are the eventual future of B2B eCommerce business. They develop a safe connection between the site/browser and the payment processor, thus encrypting payment information for each credit/check card transaction. These top 10 payment gateway in India that we shared offer simple, fast, consistent, and secure transactions. Therefore with the varied payment gateway options that we have shared, we hope, it will be simple for you to choose the best payment gateway for your eCommerce platform. Therefore, make the right choice for your online store that depends on quality standards, policies, and secures the available sensitive data.

For more details on most popular payment gateways and payment gateway processes or integrating them during your mobile app development, or some other digital assistance reach out at us.

- Android Development3

- Artificial Intelligence27

- Classified App3

- Custom App Development2

- Digital Transformation11

- Doctor Appointment Booking App13

- Dropshipping1

- Ecommerce Apps38

- Education Apps2

- Fintech-Apps34

- Fitness App2

- Flutter3

- Flutter Apps19

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care7

- IoT2

- Loyalty Programs9

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps120

- Product Engineering4

- Progressive Web Apps1

- Saas Application2

- Shopify7

- Software Development1

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized4

- Web App Development1

Comments