Developing a Mobile Wallet Application for all types of Payments

31 May 19

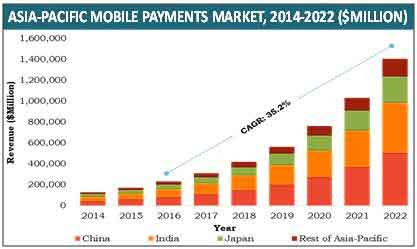

Mobile wallet apps have always been the hottest topic since the global mobile payment revenue surpassed $780 billion in 2017 and experts predict that it will cross 1 trillion by 2019. This fact proves that this may be the best time for mobile wallet app development for your startup.

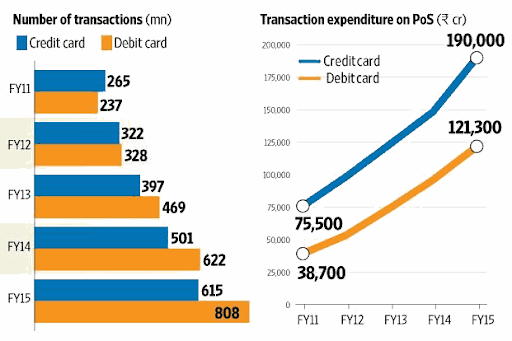

Notably, in 2015, 39% of all mobile users in the US had made at least one mobile transaction. When there is such an abundance inflow of mobile transactions, there should a payment mode and safe storage for it. This is how the idea of a mobile wallet app was born.

What is a Mobile Wallet?

A mobile wallet is an application that permits to integrate and store different kinds of payment methods like credit/debit cards or digital money (e.g. bitcoin), alongside extra stuff like coupon codes, loyalty cards etc.

While developing a mobile wallet app, you should decide the key features you are going to offer in your app. You should either offer just one feature or an advanced solution where the users could pay for goods and conduct other P2P payments.

Which industries can benefit from a mobile wallet application?

Mobile wallet app is firmly associated with the financial sector. Since such apps stores data about the debit, credit, loyalty cards, digital currencies etc. It is partially true, but how about we consider this issue from the opposite side and see what areas can benefit from online money transfer apps.

- Retail: It can be both an addition to an already built mobile app or a solution for m-commerce shop. Such apps also help users to store information about sales and also initiates payments via coupons, loyalty cards, and rewards.

- Financial Establishments: They offer users with various cards like credit, debit cards, furnish customers with administrations (for instance, installment for open administrations with Visas).

- Telecommunication companies, logistics, transportation, and tech enterprises: They act as neural players in the financial segment. They have more odds of integrating different payment cards from various banks in their mobile wallet.

If you are on the verge of mobile wallet app development, you should have an idea on the type of mobile wallet you want to develop. Features added in the app will influence in the final cost of app development.

Types of mobile wallet

There are many types of e-wallets and each has different payment processing modes. We will help you with a couple of examples:

- Wallets that uses a mobile service provider, where the users send and receives money with the help of the service provider.

- Wallets that offers a discount through SMS with an OTP or similar codes (discount is performed normally from the banking account or credit card).

- Wallets that offer mobile web payments (client sends and receives money through the mobile app).

The trends are changing nowadays since e-wallet services are incorporating with mobile communication service providers, banks, and other financial institutions.

Financial transactions are the basis of every mobile wallet. How about we consider with prior examples of how mobile wallet works to understand the technologies needed to employ a high quality service.

How does a Mobile Wallet app Work?

There are still people who are not aware of what a mobile wallet app is?

Users can initiate their app by using a password or PIN code. The users can select their card or the banking account and link it with the app to perform the transactions. Don’t forget to offer loyalty programs and special offers to the users.

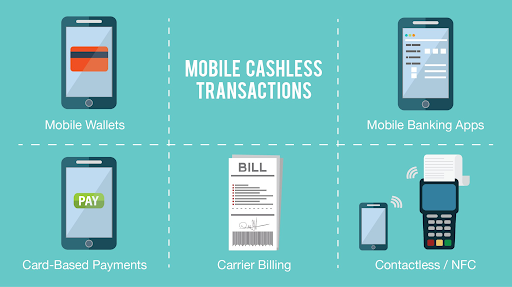

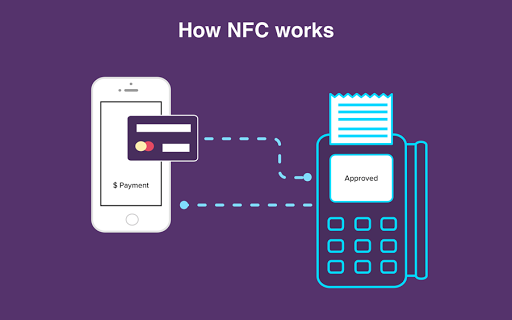

Mobile apps utilize NFC to exchange data about transactions. Therefore, entrepreneurs require a PoS system (Point of Sale) that supports NFC to initiate the payments from the smartphones. Other than that, adding different payment modes to your app can be beneficial for your application

Let’s take a look at the common use case scenarios of a mobile wallet

- Online commerce payments – When the transaction is completed online and are given a itemized receipt.

- Mobile P2P money transfer – When money is transferred from a linked users account to another account.

- Point of Sale (POS) payments happening at the storefront, where customers can use mobile technologies to settle the purchase.

How about we focus on POS payments in terms of mWallet application development

There are four different ways to empower POS mobile wallet payments:

- NFC (Near Field Communication)

- Bluetooth and iBeacon services

- QR codes

- Payment App

NFC

Near Field Communication facilitates secure, wireless transactions between an NFC-empowered phone and a transmitter attached to a POS device. The cardholder has their card stored in a digital form in their e-wallet utilizing the Host Card Emulation (HCE) technology, which is backed by Google for Android devices.

If you develop a mobile app for Android, exploiting the NFC and HCE innovation is among the best choices. Building an iOS mobile wallet application will require utilizing either EMVCo payment standards or tokenization.

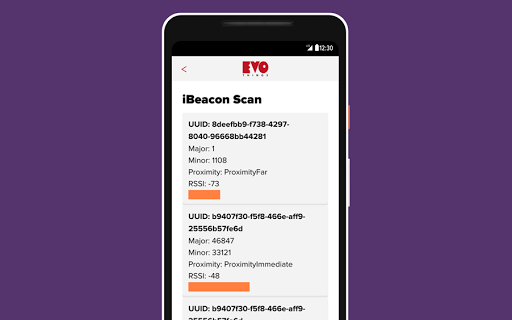

Bluetooth and iBeacon

The iBeacon is another approach to transfer the data without utilizing the internet data. Smartphones equipped with Bluetooth 4.0 can communicate with an outside BLE-transmitter called the Beacon.

Here are a few thoughts on how you can utilize this technology in your mobile wallet:

An iBeacon-empowered POS can quickly “read” the user details, which means they don’t have to swap their card or coupon amid checkout. Every one of their information will be automatically visible in the POS terminal.

You can improve in-store customer experience by sending customized deals and constant recommendations as they move along the aisle. Moreover, you offer indoor navigation with such technology.

QR Codes

QR codes are regularly utilized as an alternative for NFC. Here are the two MNC’s effectively leveraging this approach to mobile payments:

Starbucks’ mobile wallet app lets the customers link their payment modes, encode them into a secured dynamic QR code that is stored in the cloud and scan the code at the checkout.

LevelUp applications also support QR payments for registered users via NFC and iBeacon technology.

Payment Apps

Established companies like financial institutions and portable installment suppliers might need to consider joining forces with local vendors and support checking out through their app.

PayPal backed online payments are already available in many storefronts. Apple Pay and Android Pay are additionally taking a shot by expanding their service offline.

Why Mobile Wallet Security Matters

Since you are dealing with the financial transaction in e-wallet, Security plays an important role and you should prioritize it while developing such apps. Nobody would want his or her cash stolen. So let us see what can make such service secure.

Point-to-point encryption (P2PE)

An advanced and powerful security tool that protects the entire transaction from start to end. It starts encrypting the whole transaction when you swipe your smartphone over PoS-terminal, the transaction can only be initiated at this point and is moved up to the approval. This sort of protection is very important in the list of must-have features you want to include in your mobile wallet payment gateway.

Tokenization

Tokenization makes e-payments secure with the help of a data encryption system. The purchaser doesn’t need to give the vendor his or her transaction details while paying by a card. All the information in the card data is encrypted and transformed into a particular token that resembles to a combination of symbols.

Biometric Protection

If you want your app to be equipped with the latest security features, biometric protection support can be included. The user’s smartphone must be advanced enough to integrate this technology where the biometric data of your fingerprint will be required to initiate the transaction.

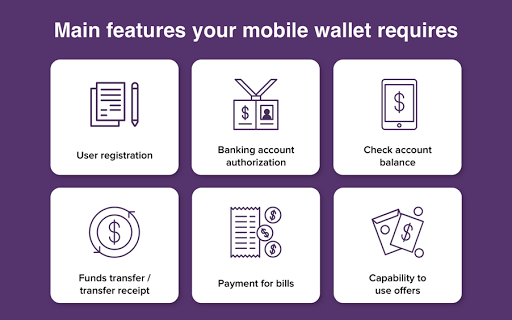

Key Features to Include in a Mobile Wallet

If you decided to find how to make e-wallet application, you should consider some basic features that every app must provide to satisfy the demands of the users.

- User Registration

- Bank Account Authorization

- Option to Check Balance

- Money Transfer

- Payment for bills

- A chance to utilize offers (discount coupons).

Additional features

Mobile wallet development as a key solution for your business can turn into the best method to orchestrate the association with your customers and increase the database of loyal users. But, to enhance your application, you should include the accompanying features in future to your digital wallets:

- Loyalty Card

- Reward Offer

- Loyalty Card with Promotional Offers;

- Gift Vouchers

- Pop-up Notification

- Exclusive offers

- Geo-Locating

- Membership Discounts.

Features defined above can benefit your business with abundant users, their enthusiasm, and valuable experiences.

So it is dependent upon you to choose what mobile wallet you need and what you should attempt to develop it. You simply need to discover all the advantages of e-wallet. Furthermore, you need to consider that there many popular and established mobile wallets in the market, so it will be not easy to grab your market share. Your future wallet application ought to have substantial features over your competitors.

- Android Development3

- Artificial Intelligence27

- Classified App3

- Custom App Development2

- Digital Transformation11

- Doctor Appointment Booking App13

- Dropshipping1

- Ecommerce Apps38

- Education Apps2

- Fintech-Apps35

- Fitness App2

- Flutter3

- Flutter Apps19

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care7

- IoT2

- Loyalty Programs9

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps120

- Product Engineering5

- Progressive Web Apps1

- Saas Application2

- Shopify7

- Software Development1

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized4

- Web App Development1

Comments