Web3 in Fintech: Decentralization Saga in Fintech’s Evolution

14 Aug 23

One of the digital transformations of the last ten years that has received the most significant attention is Web 3.0. The internet world has been talking a lot lately about Web 3.0 in fintech.

Utilizing the latest innovations like blockchain, the Internet of Things, artificial intelligence, virtual reality, machine learning, augmented reality, 5G, digital twins, cloud computing, edge computing, and even more, it is expected to revolutionize all. This is especially true in the fintech app development industry.

But what’s even more intriguing, you ask? It’s the convergence of fintech with Web 3.0! The possibilities for Web 3.0 appear virtually endless when paired with finance. Let’s determine how effective this bunch is for the marketplace and what commercial chances they could open up.

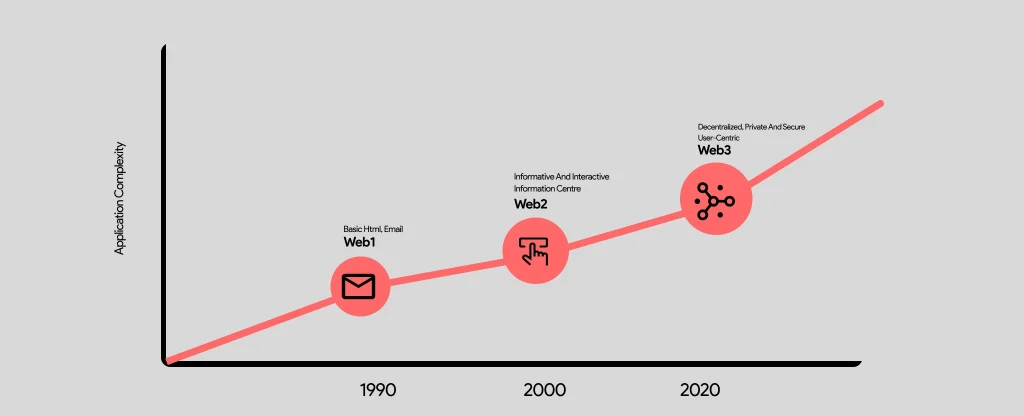

The History of the Internet

What is Web3 in Fintech?

Web3, as the title implies, is the third iteration of the online world. According to the study, the market’s value would increase by 43.7% CAGR to $81.5 billion in 2030. Web3’s decentralized network gives consumers complete authority over their online data and is free of centralized management and governing bodies.

When discussing web3 in the context of fintech, it is essential to note that web3 uses dApps, bitcoin, smart contracts, blockchain technology, and numerous additional resources to entirely decentralize financial operations and do away with the need for intermediaries. Due to its decentralized structure, Web3 seeks to provide a more open, accountable, and representative economic environment. Web3 has also replaced fiat money thanks to its use in finance.

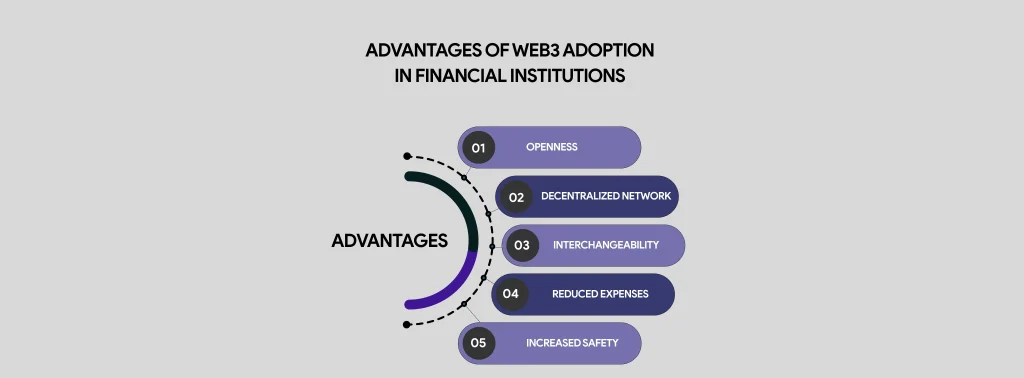

Advantages of Web3 in Fintech

With its decentralized structure and the help of blockchain technology, the Web3 idea emerged on the technological scene and started to influence several industries, including the banking sector. The rationale for why, or advantages that financial organizations can get from embracing the web3 revolution, are as follows:

1. Openness

Due to Web3’s decentralized structure, users have complete access to and management of their banking data, allowing transparency and lowering the danger of fraud. To increase customer satisfaction and encourage reliability, banking organizations can utilize this functionality to give clients an in-depth understanding of their past transactions.

2. Decentralized Network

Web 3.0 is called a decentralized internet since it lacks a centralized government, making it more reliable and immune to internet censorship. It gives consumers strict confidentiality guarantees, complete data control, and investment opportunities at a reasonable cost.

3. Interchangeability

Web3 encourages the adoption of open norms and procedures and the standardization and facilitation of peer-to-peer (DEX) trading. And it synchronizes the operation of several financial apps. In brief, web3 in a finance app creates a DeFi environment that allows for compatibility, which lowers the work, cost, and time for application users.

4. Reduced Expenses

Through emerging digital innovations like blockchain and AI/ML, the Web3 ecosystem may automate several financial operations without the influence of intermediaries. As an outcome, transaction expenses are decreased, and productivity is increased.

5. Increased Safety

Blockchain, which offers more robust safety measures than conventional banking systems, is the foundation of Web3, allowing it to exist in this challenging online environment full of cybersecurity risks.

As a result of the decentralized web3’s storage of data in pieces among numerous nodes, all of which are encrypted using a separate encryption key, the likelihood of hostile actors attempting to penetrate the security barrier is decreased. Protecting the reliability of banking networks and fostering user confidence among app users are the main reasons for the banking industry’s investment in web-3 innovation.

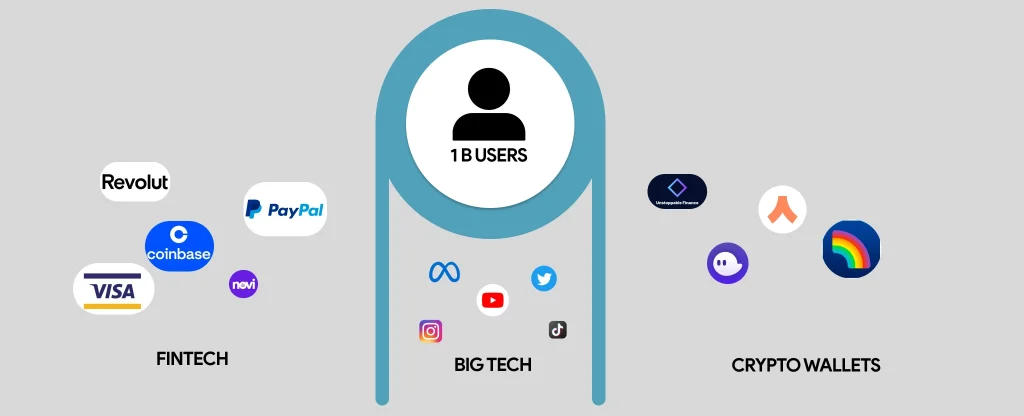

How Can the Fintech Industry Leverage Web3 Solutions?

As we know, blockchain technology is the main force behind Web3 technology. Undoubtedly, it will be essential to accept Web3 in the finance industry. Let’s investigate some possible Web 3 applications for Fintech solutions to implement and prepare your financial firm for the future:

1. Systems/Apps for Decentralized Payments

According to participants in fintech, all conventional banking services will be decentralized due to the growth of Web3 in banking. It also has decentralized finance and cryptocurrency wallets, enabling centrally controlled peer-to-peer payments with enhanced safety, openness, and availability.

You may make safe, digital payments using decentralized payment systems in the same manner as before. Therefore, you will only have to spend a little time understanding the decentralized system from the start.

2. Regenerative Finance

A trend in the finance sector known as regenerative finance (ReFi) unites banking practices that involve regeneration, long-term viability and human effect. Instead of focusing solely on revenue and externalizing societal and ecological costs, ReFi development aims to construct a system to generate a new definition of banking.

The consequences of investing, ethical finance, and socially accountable financial sectors are where the ReFi movement places its primary emphasis. As a result, it could be a potent weapon for promoting equitable relationships, sustainability, and good transformation.

3. Decentralized Finance (DeFi)

Decentralized finance, often known as DeFi, is the initial use of Web3 in banking that unlocked how we manage finances. DeFi was developed as a creative solution for conventional financial procedures such as money lending and borrowing, trading, interest-bearing on deposits, and more.

In fact, according to estimates, the DeFi market will reach $232.20 billion by 2030, at a CAGR of 42.6% from its expected value of $11.96 billion in 2021. Additionally, DeFi provides banking services accessible to specific organizations, experienced traders, and corporate leaders.

Further, you may take advantage of perks like quick and safe access to DeFi wallet services, adaptability when transferring assets across accounts, more rapid data updates, and complete openness.

4. Decentralized Insurance

Except for the inheritance decentralized insurance receives from web3, the idea of insurance is unchanged in the environment of web3. To be more exact, in the DeFi universe, investments are protected against threats such as hacking of smart contracts, problems with cryptocurrency wallets, assaults on DeFi protocols, etc., using decentralized insurance.

Because blockchain technology underpins Web3, there are few possibilities for compromised decentralized products. But it is far preferable to prepare for the worst rather than take a diversion. Decentralized insurance in Web 3 adheres to parametric insurance claim criteria. It implies you must comply with every policy’s requirements to get insurance money. And smart contracts are used to implement everything.

5. Money Management

Web3 in banking has given consumers the ability to handle their financial holdings and make money-based decisions, just like traditional fund management. Money management might refer to things like managing cash flow and exchanging currencies.

But there are, in fact, two distinct forms of decentralized fund management concerning DeFi: Active and Passive. “active fund management” refers to the procedure whereby a group of fund investors collectively decides how much money to allocate to the market. Individuals in passive fund management imitate DeFi holdings to get specific outcomes.

6. Decentralized Exchanges (DEXs)

Decentralized exchanges are similar to famous systems like Coinbase and Binance for crypto trading but are highly decentralized. DEXs enable consumers to interact with one another in a peer-to-peer design without requiring a governing body or external participation, in contrast to centralized markets that depend on intermediaries to conduct transactions.

Therefore, you may get benefits like full authority and ownership, confidentiality and safety, openness, availability, convenience, and censorship resistance by creating decentralized exchange platforms. Platforms for decentralized exchanges such as Uniswap, SushiSwap, PancakeSwap, and Balancer are widely used.

7. Derivatives

Decentralized derivatives, called DeFi derivatives, are financial contracts constructed using blockchain technology on Web3. They retain the open-source identity of the decentralized internet. Additionally, the prices of decentralized derivatives are based on a fundamental asset or an index rate.

Additionally, these derivatives can be utilized for negotiation, investment, and protection against fluctuating prices. Decentralized derivatives may be generated openly without any limits, which is another issue you should be aware of.

However, the best feature is that they may be applied like conventional derivatives. DeFi Derivative Protocols are markets and tools that exchange and employ DeFi derivatives. Synthetix, UMA, Opyn, dYdX, Perpetual, and Hegic are well-known DeFi-derived networks.

Web3 Integration Challenges within Fintech Solutions

While Web3 in finance might have many advantages, it can also present numerous difficulties because of its most crucial aspect, decentralization. As a result, the following issues arise when deploying Web3 in finance apps:

1. Collaboration

Payment gateways, KYC, and banking systems are just a few connectors in constructing fintech systems. Additionally, overcoming compatibility issues and legal barriers might be challenging when integrating Web3 and traditional banking systems with DeFi. In addition to these technological difficulties, promoting your DeFi solution and instructing customers on utilizing your software might take a lot of work.

2. Flexibility

DeFi systems have versatility issues because of their complexities and because they are based on blockchain networks. The network can get more sophisticated as more processes are added, which results in longer payment processing times and higher transaction costs. You must possess higher technical abilities to obtain high throughput and scalability in your DeFi systems.

3. Comply with Rules

Web3 technology is constantly changing, and because of its decentralized nature, it always runs into legal issues while working on DeFi. It’s not impossible, but it is a complicated and time-consuming job.

Final Thoughts

Fintech solution optimization using Web3 technology may greatly aid in transforming financial processes. It increases economic activities’ transparency, security, and productivity, among numerous other things. Employing decentralized financial solutions enables you to manage your company without the interference of legislative intermediaries.

You still require the support of Web3 in Finetch to create cutting-edge DeFi solutions. This is where Mindster enters the scene. It will assist you in making your ideal app from inception through analysis, design, development, and post-delivery assistance. Mindster is a renowned mobile app development company known for excellently developing mobile app solutions with a skilled UI/UX design team.

- Android Development3

- Artificial Intelligence27

- Classified App3

- Custom App Development2

- Digital Transformation11

- Doctor Appointment Booking App13

- Dropshipping1

- Ecommerce Apps38

- Education Apps2

- Fintech-Apps35

- Fitness App2

- Flutter3

- Flutter Apps19

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care7

- IoT2

- Loyalty Programs9

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps120

- Product Engineering5

- Progressive Web Apps1

- Saas Application2

- Shopify7

- Software Development1

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized4

- Web App Development1

Comments