From Idea to Launch- A Complete Guide for Digital Wallet App

25 Mar 24

When was the last time you made an online transaction? It may have been when you paid for food delivery a few minutes ago or just yesterday when you shopped. Just like that, online payment has become a significant part of our lives.

“Digital wallet transaction value is likely to rise significantly from $7.5 trillion in 2022 to over $12 trillion globally by 2026, according to Juniper Research”.

Of all the options for online payments, digital wallets emerge as electronic counterparts to traditional wallets, offering a secure and effortless means to conduct transactions without the need for physical cash or cards.

The increasing adoption of digital wallets is highlighted by the fact that 32% of users have more than one mobile wallet app installed on their devices. While major players like Apple Pay, Google Pay, and PayPal currently lead the market, there is ample room for innovative solutions to enhance the digital payment landscape further.

Digital wallets streamline the payment process, providing a seamless experience whether shopping in physical stores, online, or via apps. This simplifies money management and enhances your overall payment processing strategy.

In this blog, we will discuss digital wallets, their benefits, their development process, their challenges, and more.

What is a Digital Wallet?

A digital wallet, or an e-wallet, is a virtual platform that securely stores users’ payment information, such as credit card details, bank account information, and passwords for various online payment methods and websites. Digital Wallet enables users to complete transactions with ease and security.

The stored payment information can be used to make online purchases, pay bills, or conduct in-store transactions using a smartphone, eliminating the need to carry physical cash or cards.

Digital wallets are not limited to just storing payment information. They can also be used to hold gift cards, membership cards, coupons, and event tickets. Did you know that some digital wallets come with advanced features like confirming age when making purchases like alcohol?

This makes digital wallets a versatile option for managing different types of cards and simplifying transactions.

A digital wallet can perform the following functions:

- Securely store payment information.

- Facilitate online and in-store payments.

- Transfer money to other users.

- Manage loyalty cards and coupons.

- Store identification and ticketing information.

- Track transaction history and spending habits.

Also read: Transforming Payment Experiences: Digital Wallet Mobile App Development

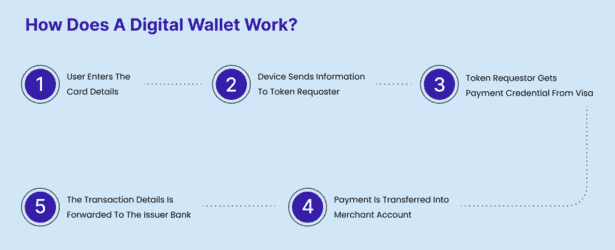

Understanding The Operations of Digital Wallets

Using sophisticated technologies like data encryption and tokenization, digital wallets securely store users’ payment information and provide a convenient way to make electronic transactions. Whenever a transaction is initiated, digital wallets access stored payment information, and facilitates transfer of funds.

Tokenization enhances security by replacing sensitive payment information with unique tokens during transactions, ensuring superior financial security and curbing unauthorized access.

To complete transactions, different digital wallets employ distinct technologies such as:

- NFC (Near Field Communication): Some digital wallets, like Apple Pay and Google Pay, utilize NFC technology to enable contactless payments. With NFC, users can hold their smartphone or wearable device near a compatible payment terminal to complete a transaction.

- QR Codes: Certain digital wallets allow users to make payments by scanning QR codes. This is commonly used in mobile payment systems where the merchant displays a QR code, and the customer scans it using their digital wallet app to initiate the transaction.

- Tokenization: Digital wallets often use tokenization to enhance transaction security. This technology replaces sensitive payment information, such as credit card numbers, with unique tokens. These tokens are then used for transactions, reducing the risk of exposing actual card details to potential fraud.

- Biometric Authentication: To confirm the user’s identity prior to completing a transaction, a lot of contemporary digital wallets allow biometric authentication, such as fingerprint or facial recognition. This strengthens the security of the payment procedure even further.

- Blockchain Technology: Some digital wallets, especially those used for cryptocurrencies, leverage blockchain technology to record and verify transactions securely. This decentralized and distributed ledger technology provides transparency and security for digital asset transactions.

By employing these diverse technologies, digital wallets cater to varying user preferences and offer secure and convenient methods for completing a wide range of transactions.

Also read: Unleashing the Power of Biometrics Technology for Advancing Digital Banking

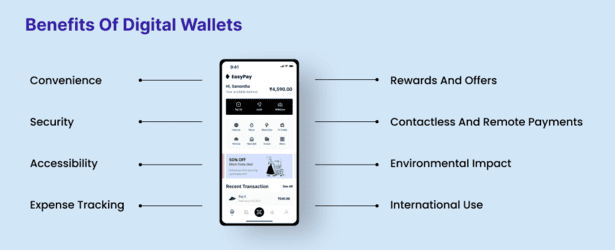

Benefits of Digital Wallets

- Convenience: Digital wallets make it easy to store payment information and complete transactions without physical cards or cash. It’s as simple as tapping or scanning with a smartphone.

- Security: They use advanced security measures like encryption and biometric authentication to protect your payment details, ensuring robust security.

- Accessibility: Digital wallets offer a wide range of payment options in one place, including credit/debit cards, loyalty cards, and even cryptocurrencies.

- Expense Tracking: Many digital wallets help track and categorize expenses, giving you insights into your spending habits and making it easier to manage your money.

- Rewards and Offers: Some digital wallets provide exclusive discounts, bonuses, or cashback for users who use the wallet for transactions, adding extra value for users.

- Contactless and Remote Payments: They support contactless payments in-store and enable secure and convenient remote transactions for online purchases and bill payments.

- Environmental Impact: Digital wallets reduce the need for physical cards and receipts, contributing to environmental sustainability by minimizing paper usage and waste.

- International Use: One of the major advantages of digital wallets is they can be a great enablers of international transactions, offering a seamless payment experience for travelers without the need to carry multiple currencies or deal with currency conversion.

In summary, digital wallets offer,

- Convenience

- Security

- Financial management tools

- Additional value through rewards in one accessible and environmentally friendly package.

Are Digital Wallets Safe?

Digital wallets utilize strong security measures such as Strong Customer Authentication or SCA, Multi-layer verifications, OTP generation, etc. and a slew of advanced technologies like end-to-end data encryption, tokenization, and biometric authentication to protect payment details. These technologies ensure.

- Superlative financial security

- Continuous tracking to detect any potential threats or unauthorized access

- Risk detection & mitigation measures are in place

- Best practices are followed to avoid mala fide activities

- Eliminates unauthorized access

It’s essential to select a well-established and trusted digital wallet provider and to follow best practices for online security, such as using strong, unique passwords and enabling additional security features like two-factor authentication when available. By doing so, you can have confidence in the security of your financial information stored within a digital wallet.

Why to Invest in Digital Wallets: A Statistical Perspective

You may wonder why you must invest in digital wallets; however, the statistics may answer your queries.

- According to the FIS Global Payments Report, cash transactions are projected to represent only 12.7% of point-of-sale spending by 2024, while digital wallets are forecasted to make up 33.4% of these transactions.

- The shift to electronic payments, especially mobile payments, is gradually supplanting traditional payment methods. Mordor Intelligence projects a remarkable 29.5% growth in mobile payments between 2021 and 2026, and Juniper Research predicts, and Juniper Research predicts a substantial 60% increase in the value of digital wallet transactions by 2026.

- As indicated by Mordor Intelligence, the mobile payments market is expected to experience a notable CAGR of 24.5% from 2021 to 2026, resulting in a market value of $5399.6 billion.

- A significant finding from Statista reveals that 32% of digital wallet users utilize three or more digital wallets, highlighting the diversity in digital wallet usage.

- Research and Markets anticipates that the volume of non-cash transactions in the global market will exceed 1.5 trillion by 2025, signifying the substantial growth of digital transactions.

- Juniper Research forecasts immense growth in the total number of digital wallet users worldwide, projecting a surge to over 5.2 billion by 2026 from 3.4 billion in 2022, indicating robust growth of over 53%.

Key Features to be Considered to Incorporate into Your Digital Wallet

In developing a digital wallet, it is crucial to differentiate between core and non-core features to ensure the product’s success and user satisfaction. Let’s break down some essential functionalities to include in a finance-based application:

Core Features

1. Secure Account Setup and Management:

- The streamlined registration process with robust identity verification.

- User-friendly account management tools for profile and payment method updates.

2. Fund Management:

- Seamless integration with multiple funding sources, such as bank accounts and credit/debit cards.

- Real-time balance tracking and transaction history for transparent fund management.

3. Payment Capabilities:

- Support for in-store and online purchases through various channels, including NFC, QR codes, and e-commerce integrations.

- Peer-to-peer (P2P) transfer functionality for easy fund sharing among users.

4. Security Measures:

- Multi-factor authentication for login and transactions to enhance account security.

- End-to-end encryption of sensitive data and transactions to protect user privacy.

5. Notification and Alerts:

- Customizable push notifications for transaction alerts, account updates, and security notifications.

- Timely alerts for low balances, significant transactions, and unusual account activities.

Non-Core Features

1. Financial Management Tools

- Budgeting and expense tracking features to help users manage their finances effectively.

- Integration with financial planning tools for investment tracking and financial goal setting.

2. Loyalty Program Integration:

- Support for loyalty point tracking and redemption within the digital wallet application.

- Seamless integration with retail and service providers’ loyalty programs for enhanced user benefits.

3. Customer Support and Assistance:

- In-app chat or support features for quick resolution of user queries and issues.

- Access to comprehensive FAQs, tutorials, and educational resources for user assistance.

4. Personalization and Customization:

- User preferences customization for interface themes, notification settings, and account preferences.

- Tailored product recommendations based on user transaction history and preferences.

5. Value-Added Services:

- Integration with additional financial services, such as microloans, insurance, or investment products.

- Access to exclusive offers, discounts, and financial advice tailored to the user’s economic behaviour.

Six Key Steps to Create a Digital Wallet

Creating a successful digital wallet app starts with identifying user needs and market opportunities and then progresses through design, development, testing, deployment, launch, and ongoing maintenance and support. Let’s explore each stage in detail.

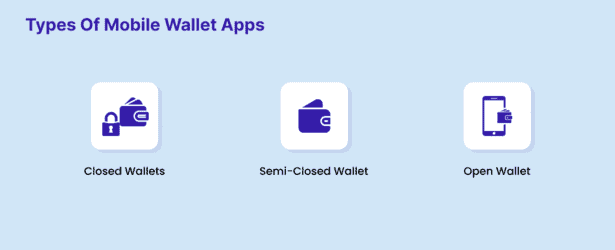

1.Discover Types of Wallets

When developing a digital wallet app, it’s crucial to first understand the various types of wallets available, including open, closed, and semi-closed wallets.

- Open Wallets: Open wallets are interoperable and can be used for any transaction, including third-party transactions such as bill payments, retail shopping, and fund transfers. They are often issued by banks or financial institutions and comply with regulatory guidelines.

- Closed Wallets: Closed wallets are specific to a particular merchant or service provider. They are often used for transactions within the issuing entity’s ecosystem, such as purchasing goods or services from a specific retailer.

- Semi-closed Wallets: Semi-closed wallets allow users to transact with a group of identified merchants, enabling the purchase of goods and services within a defined network.

Understanding these distinctions is essential as it helps determine the scope of the digital wallet app and the regulatory compliances required based on the type of wallet chosen.

2. Choose Platform and Tech Stack

Selecting the right platform and technology stack is crucial for the success of a digital wallet app. Factors such as the target audience, security requirements, and scalability must be considered. For instance, cross-platform compatibility becomes vital if the focus is on a global audience.

When it comes to the tech stack, ensuring robust security measures, seamless integration with payment gateways, and a user-friendly interface are paramount. Additionally, the choice between native, hybrid, or web-based development should align with the app’s requirements and the development team’s expertise.

3. UI/UX design

The UI UX Design process and its implementation play a pivotal role in the success of a digital wallet app. The layout should be simple to use, visually appealing, and intuitive. Users should be able to perform transactions swiftly and securely, focusing on accessibility and inclusivity.

Personalization, clear call-to-action buttons, and a minimalistic design approach can enhance the user experience. It’s also essential to ensure that the app complies with accessibility guidelines to accommodate users with diverse needs.

4. Develop an MVP and Test

Developing a Minimum Viable Product (MVP) allows for the development and testing of the digital wallet app’s core features. This iterative approach enables early user feedback, which can be invaluable in refining the app’s functionality and addressing any issues.

Thorough testing ensures the app is secure, reliable, and user-friendly. Testing should encompass functionality, security, performance, and user acceptance testing to identify and rectify any issues.

5. Launch

The launch phase involves deploying the digital wallet app to the intended audience. Effective marketing and communication strategies are vital to create awareness and attract users. Partnerships with financial institutions, retailers, and other service providers can facilitate a successful launch.

6. Maintain

Continuous maintenance is crucial for the digital wallet app’s success. This involves monitoring the app’s performance, addressing user feedback, releasing updates, and ensuring compliance with evolving regulations and security standards. Regular maintenance ensures the app remains secure, functional, and aligned with user needs and industry best practices.

How to Set Up a Secure Digital Wallet?

When you use tokenized card details, retailers cannot access your card number. This reduces the risk of fraudsters obtaining or using your financial information.

To enhance security further, you can:

- Strong Encryption: Implement robust encryption to protect the data stored in the digital wallet from unauthorized access.

- Extra Verification: To add an extra layer of protection, utilize additional security measures, such as biometrics or two-factor authentication.

- Secure Communication and Fraud Monitoring: Ensure that all communications between the digital wallet and its servers are safe, and implement systems for monitoring transactions in real time to detect and prevent fraudulent activities.

- Regular Updates and Security Checks: Update the digital wallet software with the latest security patches and conduct regular security checks to identify and address potential vulnerabilities.

- User Education: Provide users with guidance on best security practices to enhance their awareness of potential risks and how to mitigate them effectively.

Challenges in Developing a Digital Wallet

Developing a digital wallet comes with various challenges. Let’s take a quick look at those challenges.

- Security Concerns: Ensuring the digital wallet is secure from cyber threats and fraud is a significant challenge. Protecting users’ financial information and transactions from unauthorized access is vital.

- User Trust: Gaining and maintaining users’ trust is crucial. Users need confidence in the digital wallet’s security and reliability, which can be challenging to establish.

- Regulatory Compliance: Adhering to complex and evolving financial services and data protection regulations presents a challenge. Developers need to navigate these regulations to ensure compliance.

- Interoperability: Making the digital wallet compatible with various payment systems and financial institutions can be challenging. Ensuring seamless integration and functionality across different platforms is crucial.

- User Experience: Creating a user-friendly interface and ensuring a smooth user experience while maintaining high-security standards is a balancing act and a challenge for developers.

Final Thoughts

Creating a digital wallet app involves many stages and processes, taking you from the initial idea to a fully functional one.

The ongoing market trends show that more people are using mobile wallets, offering an excellent opportunity to benefit from your innovative ideas and achieve significant business success. It is safe to say that conditions are conducive to enter the digital wallet industry for the following reasons:

- There is a growing demand for convenient fintech solutions and enhance overall customer satisfaction.

- Central governments globally are being extremely supportive by rolling out various initiatives to encourage fintech innovation.

- More regulations are in place to foster an ecosystem that’s fair and accountable. This is encouraging more players to enter the market.

- Not wanting to be left out of the highly lucrative and booming fintech sector, multi-million-dollar global giants are investing in fintech big time, contributing to better international collaborations.

Want help in connecting with the best digital wallet service providers? Feel free to get in touch with us. We’re here to assist you and turn your vision into reality.

FAQs

1. How do digital wallets work?

Digital wallets, also known as e-wallets, work by storing a user’s payment information securely on a digital device. When making a purchase, the user can use the digital wallet to authorize the transaction without the need to input their payment details each time.

2. Are digital wallets secure?

Digital wallets are designed with multiple layers of security, such as encryption and tokenization, to protect the user’s financial information. Additionally, many digital wallets offer features like biometric authentication and two-factor authentication to enhance security.

3. What type of payments can I make with a digital wallet?

Digital wallets can be used to make various types of payments, including online purchases, in-app purchases, peer-to-peer transfers, bill payments, and contactless payments at retail stores using Near Field Communication (NFC) technology.

4. Which digital wallet should I choose?

The best digital wallet for an individual depends on their specific needs and the features offered by different providers. Factors to consider include supported payment methods, security features, compatibility with devices, and the availability of rewards or cashback programs.

- Agentic AI1

- Android Development3

- Artificial Intelligence33

- Classified App3

- Custom App Development5

- Digital Transformation12

- Doctor Appointment Booking App14

- Dropshipping1

- Ecommerce Apps40

- Education Apps2

- Fintech-Apps37

- Fitness App4

- Flutter4

- Flutter Apps20

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care10

- IoT2

- Loyalty Programs9

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps128

- Product Engineering6

- Progressive Web Apps1

- React Native Apps2

- Saas Application2

- Shopify9

- Software Development3

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized6

- Web App Development1

Comments