Digital Transformation in the Banking Industry

30 May 23

Banking has undergone a significant digital transformation beyond a conventional to a digital environment. Therefore, financial firms must use a comprehensive digital transformation plan to analyze, connect with, and please their consumers.

Gaining insights into client behavior, preferences, and needs serves as the initial step in adopting a fundamental approach to digitalization in the banking and fintech sectors.

The banking industry has changed from being product-focused to becoming customer-oriented as a result. We can now cover how digital transformation influences the banking industry.

Evolution from Conventional to Digital Banking

The evolution of digital banking started decades ago. However, there were significant challenges faced during the same period. As financial executives realized that most of their consumers were using online platforms, a pattern towards digital banking began.

What does the transition from conventional to internet-based media seem like as it develops? First, let’s review the good points. Omni-channel became popular in the banking sector as more clients used their mobile devices and web pages to complete payments.

Consequently, the emergence of mobile banking has become an essential element in the shift towards digital banking. Conventional financial institutions had to adopt new technology and business models to keep them informed across the whole client experience and keep up with the rapidly evolving market.

What is Digital Transformation?

Digital transformation refers to the application of digital technology throughout all business functions, which profoundly impacts how organizations function and provide value to their clients. It is a complete organizational change that affects all facets of the company, including culture, framework, procedures, and goods.

Digital transformation is possible because of several technological developments. This includes the spread of intelligent devices, the advent of IoT, and the appearance of AI and machine learning.

In addition, by enabling organizations to gather and analyze data at a never-before-seen scale, these technologies create new possibilities for analysis and creation. Digital transformation, moreover, includes more than just technology.

It transforms how companies run operations to make them more adaptable, customer-focused, and data-driven. Programs for digital transformation are guided by a distinct strategic objective and facilitated by comprehensive organizational change management if they are to be effective.

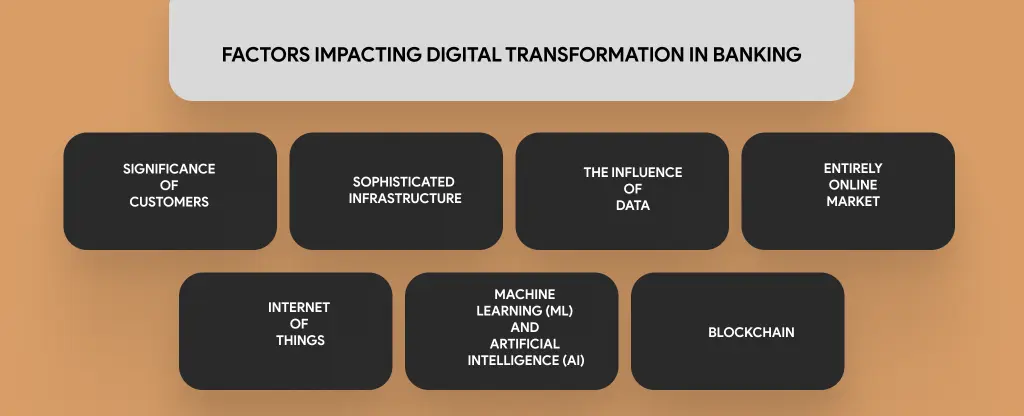

Factors Impacting Digital Transformation in Banking

The trend towards digital transformation in the banking industry , which brings financial products to consumers’ doorsteps, is primarily driven by rising smartphone usage, increasing connections, and increasing customer demand.

Significance of Customers

How will banks switch to online platforms? This is because the clients are on digital media. Digital transformation aims to fulfill the demands and desires of the target audience.

With contemporary technologies, banks now provide personalized product experiences, frictionless inquiry decomposition, openness, and safety, considering customer satisfaction and loyalty.

Sophisticated Infrastructure

As was already established, successful digital transformation requires more than simply using contemporary technology. However, due to the supporting infrastructure that makes data accessible to front-end processes, the digital transformation of the banking sector has improved today.

The Influence of Data

Banking and financial services companies are mindful of customer information’s influence. However, additional data analytics techniques must be implemented to analyze and track client trends.

This development has assisted the banking industry in delivering more relevant products and services that align with the demands of consumers. In addition, large fintech companies likely use development firms to handle their data analytics needs.

Entirely Online Market

We must recognize that every industry, including industrial, online shopping, agriculture, information technology, and others, is advancing with technological advances. This covers the organizational culture, tools, methods, and expertise needed for a digital transformation path. Considering the facts, transforming banking to digital is the impending digitalization of the whole customer base.

Therefore, we have discussed digital locations in banking and other financial organizations. However, we have not determined what technology will bring about this economic change. Let’s take a more comprehensive look at some virtual devices and innovations banks employ to boost digital lending while improving the client experience.

Machine learning (ML) and Artificial Intelligence (AI)

AI-powered virtual advisors and chatbots employed in the banking sector utilize advanced technology to provide customers with the necessary information to resolve issues. Additionally, artificial intelligence is employed to manage and analyze data, ensure data safety, and improve the customer experience. For instance, AI may spot repeating trends by quickly analyzing customer data.

Another tool that banks may employ to collect, store, and compare consumer data in context is machine learning. Machine learning helps the banking sector in its ability to effectively detect and prevent fraudulent activities. By utilizing machine learning, it becomes easier to detect alterations in user behavior and promptly take necessary measures to mitigate them.

Internet of Things

Real-time data evaluation made possible by the Internet of Things helps personalize and modify the client experience. For example, customers may easily make contactless payments within minutes because of the IoT and smart device integration.

Additionally, IoT is impacted by introducing risk management, authorization procedures (using biometric sensors), and entry to several platforms. The economic landscape has undergone a profound transformation due to the extensive influence of the Internet of Things.

Blockchain

When discussing the implementation of digital banking, blockchain technology plays a vital role. Integrating blockchain technology within the banking industry has enhanced security during data transfers, increased accuracy, and improved user interfaces.

In addition, contemporary consumers strongly trust blockchain technology, perceiving it as a catalyst for enhanced convenience and transparency in financial transactions. Hence, the amalgamation of blockchain and Internet of Things (IoT) technology has emerged as a noteworthy advancement in the realm of digital banking.

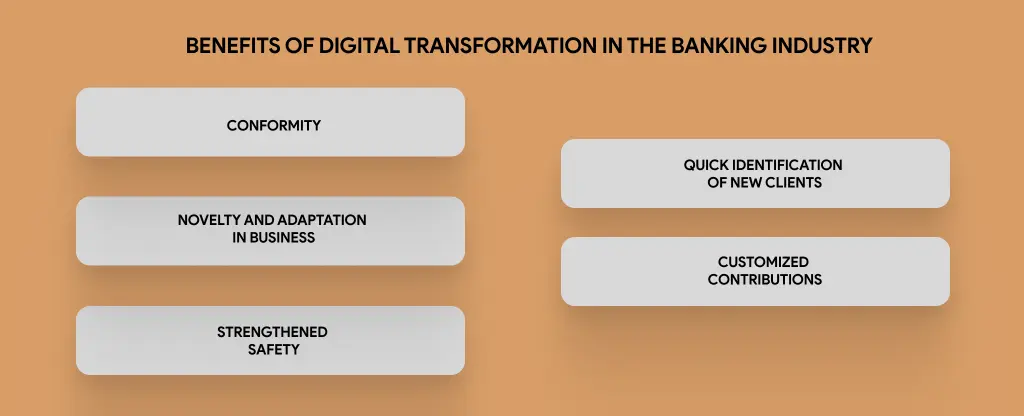

Benefits of Digital Transformation in the Banking Industry

Conformity

With the advent of the contemporary digital financial management framework, compliance has become simpler for banks to maintain. Thanks to sophisticated capabilities like auto auditing, employees spend fewer hours evaluating documentation and reports.

In addition, digital data maintains its standardization and may be flawlessly exchanged across several systems. Additionally, the cloud-based digital payroll system offers rapid updates, enabling banks to efficiently manage evolving requirements.

Quick Identification of New Clients

Customers and businesses both need each other’s services. Banking organizations are increasingly cynical regarding their offerings, making it easier and more affordable to attract fresh clientele across various industries, including but not limited to banking. Thanks to rapid digital payments, every client and company may function without hassles.

Novelty and Adaptation in Business

The emergence of social media, e-commerce websites, and mobile banking applications has provided banks and other businesses with an expanded array of channels to engage and connect with their clients. With the digitalization of the banking industry, numerous new company advancements now heavily rely on financial services.

Strengthened Safety

Among the challenging problems that businesses and organizations are battling to solve is the protection of consumer information. Banks may now use innovative software development services to safeguard confidential data. This also includes securing customer accounts from fraudsters, cyber assaults, phishing, and other threats.

Customized Contributions

Banks can now provide clients with the precise services they require thanks to the digital transformation of banking and financial services. Financial institutions now formulate their goods and offers based on the consumer’s spending. This approach is significantly more precise than relying on assumptions.

Digital Trends in Banking Industry

Increasing Use of Online Payments

Recently, there has been an unheard-of revolution in payment options. Cash-based payments are beginning to be replaced by card-based payments and Internet payment methods. Financial institutions continue working with public and private banks to develop innovative online payment apps.

Foreign transactions may now be completed quickly and securely thanks to several smartphone applications, including PayPal. Thanks to technological improvements, we predict that there will be an increase in internet-based or electronic payment techniques in the upcoming years.

Greater Collaboration

The banking industry is experiencing swift and profound changes, and banks must work together and coordinate better. Increased collaboration has several benefits, including improved branding, more significant development, dedicated customers, and fresh service offerings.

The fintech idea allows banks to work with other kinds of banks to develop cutting-edge goods for clients. As a result, it can increase banks’ profitability and efficiency.

Adaptive Methods

Not only do banks currently confront rivalries, but isn’t that intriguing? Some significant causes for the increased adoption of digital transformation in banking are expanding problems and increased competitiveness.

Banks frequently develop novel marketing approaches based on more effective data collection and analysis tools. Along with seizing new chances, banks are also committed to improving the efficiency of their customer-facing channels to keep their current clients for an extended period of time.

Better Data Consumption

Worldwide, mobile has emerged as the new standard. During the epidemic, people were driven to use Internet banking and other services. But as the post-pandemic period has continuously risen, this tendency is set to stay. According to a report by Insider Intelligence, 89 percent of clients conduct banking tasks on mobile devices.

Therefore, protecting sensitive data while enabling targeted, real-time access in this mobile-driven world is crucial. Big data, blockchain, cloud computing, and robotic process automation (RPA) are incredibly intriguing innovations that might revolutionize banking procedures. These developments will propel banks towards expansion in the upcoming years.

Summing Up

Banks must invest in digital transformation due to several factors, including low-interest rates, shifting consumer behavior, increasing rivalry, and compliance hurdles. By quickening the speed of digital transformation, banking procedures are optimized to provide better client experiences.

As a result, the banking industry is poised for development and success due to digital transformation. If you are interested, contact Mindster, at www.mindster.com as we integrate digital transformation for our clients.

- Agentic AI1

- Android Development3

- Artificial Intelligence33

- Classified App3

- Custom App Development5

- Digital Transformation12

- Doctor Appointment Booking App14

- Dropshipping1

- Ecommerce Apps40

- Education Apps2

- Fintech-Apps37

- Fitness App4

- Flutter4

- Flutter Apps20

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care10

- IoT2

- Loyalty Programs9

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps128

- Product Engineering6

- Progressive Web Apps1

- React Native Apps2

- Saas Application2

- Shopify9

- Software Development3

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized6

- Web App Development1

Comments