The evolution of fintech app development services has created a drastic change by integrating mobile apps to provide customers with financial solutions and services. This type of financial technology used in the current era is known as fintech apps. Therefore, the future of fintech has paramount importance.

This technological upgrade has simplified the management of financial activities through various characteristics, such as supporting budgeting processes, investment opportunities, and financial counseling.

Therefore, as the banking industry develops due to technological improvements, the role of fintech applications in managing our accounts and successfully traversing the financial world becomes increasingly crucial. Therefore, the current blog will cover how mobile apps play a significant role in determining the future of fintech.

What is a Fintech App?

Fintech apps provide various financial services, including savings, investment, planning, and handling payments. In addition, fintech apps allow consumers to regulate their financial affairs online without going to a bank office.

By using encryption and other security measures, these applications prioritize protecting user data and financial activities. Furthermore, several programs offer real-time updates to help users stay updated on their fiscal activity.

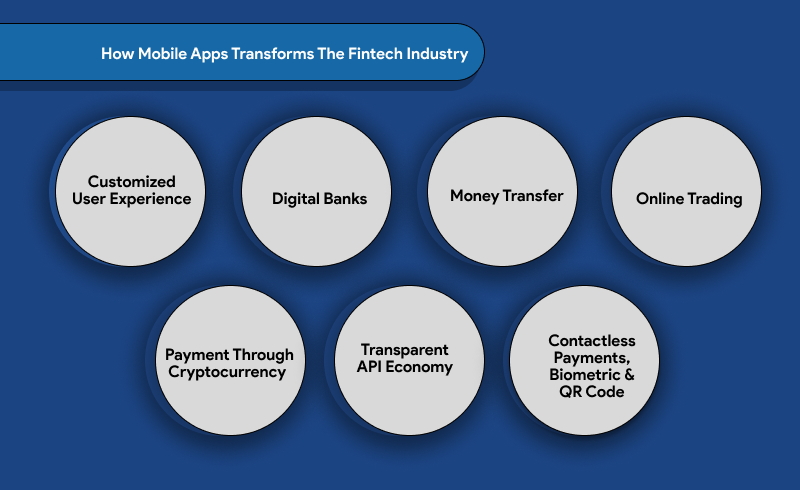

How Mobile Apps Transforms The Fintech Industry

The financial sector has recently seen a significant upheaval, with the rise of fintech app development businesses as catalysts. These forward-thinking businesses are revolutionizing the future of fintech, how we handle our finances by upending established financial structures with technology. Fintech applications are transforming how we access and utilize financial amenities, from mobile payment methods and digital banking to investing and budgeting tools.

Customized User Experience

Recent innovations, including artificial intelligence, are incorporated into fintech apps to provide a personalized customer experience. Thanks to the customer-specific user interface, users can communicate with mobile app development companies more quickly and easily. Because fintech applications use sophisticated statistical analysis, demands from clients gets noted by giving people the things they desire.

Additionally, it is now possible to spot patterns in their behavior so that contents gets presented to consumers in an approach that most closely meets their demands. Additionally, it has made it simple for banking organizations to do decision-supporting prediction analyses using customer data. Intelligent mobile applications like Potential Finance are created to provide more practical ideas and solutions by analyzing users’ expenditures, borrowing, and saving activities.

Digital Banks

Digital banks, sometimes called online-only or neobanks, have expanded significantly, thanks to fintech app development companies. These businesses have created the technological infrastructure to enable digital banking services, including mobile banking applications, online payment gateways, and other money management tools.

Offering simple and convenient financial services via a smartphone or other electronic gadget is one of the main benefits of digital banks improving the future of fintech. With a digital bank, users may effortlessly control their accounts from any location with access to the internet by checking their wallet balances, making payments, transferring money, and so on.

By adding sophisticated safety measures like multi-factor authentication, encryption, and anti-fraud algorithms, fintech app development companies have also contributed to safeguarding online banks. These precautions assist in securing consumer financial data and preventing unlawful entry into their accounts. Fintech app development firms like us have significantly aided in the expansion and acceptance of digital banks by making it more straightforward for users to connect with and handle their funds online.

Money Transfer

Fintech app development businesses create financial management tools and a variety of electronic payments, simplifying the movement of funds. For example, mobile banking applications and e-wallets enable people to send and get cash using their phones or gadgets. They are among the most well-liked and practical methods of money exchange. Users may send money fast and privately because of the intuitive user interfaces and availability of these applications across several devices.

Fintech app development firms have created online payment gateways and other digital payment tools, including Bitcoin. Besides, mobile banking apps are used to conduct safe and decentralized monetary transactions. Without travelling to a tangible location or interacting with a conventional banking institution, these payment alternatives have simplified it for people and organizations to transfer money internationally.

Online Trading

Robo-advisors are an instance where fintech is altering financial trading. These online services employ algorithms to monitor investor portfolios and offer investing advice. Compared to conventional economic consultants, robo-advisors gets accessed via mobile devices or computers.

As a result, they frequently provide reduced costs and more individualized financial suggestions resulting into improved future of fintech. Using mobile trading applications is another way that fintech is altering market trade.

For example, people may trade shares, bonds, and other assets using these applications on their tablets or smartphones. Mobile trading applications frequently use real-time market data and sophisticated charting tools. These features assist traders in making wise selections.

Payment Through Cryptocurrency

Blockchain technology has created new methods for managing and storing data and changed payment gateways. The latest financial tools are cryptocurrency systems, which use robust Blockchain technology to provide safe transactions.

The use of advanced technologies boosts the future of fintech. You can transfer multiple cryptocurrencies, such as bitcoins, to someone in another country or part of the world far from you via cryptocurrency payments. This decentralized technology has transformed the banking industry, and enhanced business procedures.

This payment method eliminates the requirement for a third-party connection for consumers to have complete authority over their data. An iPhone app development business has launched blockchain wallets that keep track of every transaction you make. It is the most advanced banking method, which enhances Android fintech apps and makes the entire system accessible and safe.

Contactless Payments, Biometric & QR Code

Mobile banking applications are revolutionizing how funds gets managed by offering various payment options. Mobile apps like Samsung Pay and Apple Pay have introduced a clever contactless payment method that enables customers to purchase digitally without using credit or debit cards. Users may make contactless payments without being concerned that someone will steal their personal information because every payment is encrypted.

The integration of contactless payments also determines the future of fintech.In addition, a safe biometric wireless payment technique also attracts interest since it enables bill payment online and does away with the requirement for physical receipts.

Fintech organizations are integrating technologies such as biometric recognition and QR code generator online services into mobile apps to allow seamless and secure payments possibilities. These innovations ensure that users have a variety of convenient payment methods at their disposal, enhancing the overall efficiency and reliability of financial transactions.

Your banking applications can read QR codes to provide you with a quicker, more straightforward, and more effective payment option.

Transparent API Economy

Fintech organizations depend on cutting-edge technologies, including AI, IoT, and blockchain, for effective company operations. As technology advances, fintech applications will include higher-value services, goods, attributes, and capabilities.

In addition, data exchange across systems is possible via accelerated programming interfaces (API), which are effective, dependable, and secure to develop better future for fintech. Thanks to app development companies. The existing financial mobile applications easily updates with novel or older functions.

In addition, users get significant freedom, which raises the number of their transactions, through incorporating third-party services into mobile banking applications. API integration offers improved digital services, such as location-based services, so that consumers may discover an ATM nearby.

Summing Up

A fintech app development business significantly influences the financial sector, upending established financial institutions and revolutionizing how we get and utilize money services. The businesses have created a variety of cutting-edge technologies. These technologies have significantly increased the efficiency, connectivity, and integrity of monetary services.

The advancements range from mobile payments and digital banking to investing and budgeting applications. Fintech app development businesses will probably continue to be crucial in determining how the financial sector develops and incorporates new technology, contributing to better future of fintech.

Ankitha is a professional content writer with more than four years of experience. She writes blogs relevant to the services that we provide and also about the various mobile app solutions that we provide. With strong research skills and critical thinking skills, she can develop high-quality content that is valid and authentic. She also has good communication skills to interact with the team members to build up-to-date content related to the latest technologies.