7 Best Practices for ensuring high Security of mobile banking apps

23 Apr 24

In a Mobile banking application, data security is the most critical aspect. If security is compromised, , there can be serious repercussions, both in terms of money and reputation. Apart from hefty fines, data breaches and fraud attracts reputational damage and loss of customer trust.

“42% of banking customers avoid using mobile banking apps due to security concerns, while 46% of current mobile banking app users worry about the risk of their accounts being hacked.”

To avoid these problems, prioritizing data security is imperative when creating mobile banking apps. This includes implementing strong security measures, ensuring customer data is safe, and regularly checking the system for vulnerabilities.. Sensitizing customers on how to use mobile banking apps safely helps too.

Incorporating secure SDLC best practices is crucial in securing mobile banking applications. By effectively integrating security into every phase of the Software Development Life Cycle, from requirements to deployment and maintenance, developers can minimize vulnerabilities. This involves establishing security requirements, adopting a secure design framework, ensuring robust coding standards, thorough security testing, and ongoing maintenance for all applications. Leveraging these practices can significantly lower the risks tied to common vulnerabilities outlined above.

When banks make mobile banking app security a priority, they can keep their customers’ information safe, prevent fraud, and eliminate chances of reputational damage.

If you’re worried about the security of your mobile banking app, don’t be! This blog will help you understand the threats and how to protect your mobile banking app from them. Now, let’s explore why mobile banking apps are vulnerable to cybercrimes.

Main Vulnerabilities of Mobile Banking Apps

Mobile banking apps have revolutionized the way people manage their finances, but they also come with inherent vulnerabilities that can pose significant risks to users’ security and functionality. These vulnerabilities can be categorized into design errors, coding errors, testing errors, deployment errors, and the potential risks associated with malicious code.

Design Errors

Design errors in mobile banking apps can lead to vulnerabilities such as:

- Inadequate encryption: Weak encryption or improper implementation of encryption methods can make sensitive data susceptible to interception.

- Insecure data storage: If the app stores sensitive information locally on the device without proper encryption, it becomes vulnerable to unauthorized access in case of device theft or loss.

Coding Errors

Coding errors can introduce vulnerabilities such as:

- Insecure data transmission: Improper handling of data during transmission can lead to interception and unauthorized access.

- Lack of input validation: Failure to validate user input can open doors to injection attacks such as SQL injection or cross-site scripting.

- Inadequate session management: Flaws in session management can result in unauthorized access and session hijacking.

Testing Errors

Testing errors in mobile banking apps can lead to vulnerabilities such as:

- Inadequate security testing: Insufficient testing for security vulnerabilities can result in undetected flaws that can be exploited by attackers.

- Lack of compatibility testing: Failure to test the app on various devices and operating systems can lead to vulnerabilities specific to certain configurations.

Deployment Errors

Errors during the deployment phase can introduce vulnerabilities such as:

- Insecure update mechanism: If the app update process is not secure, it can be exploited to deliver malicious code to users’ devices.

- Improper configurations: Misconfigurations in server settings or other components can create security weaknesses.

Malicious Code

The deployment of malicious code poses significant risks, including:

- Trojan horses: Malicious code can be designed to masquerade as a legitimate app and steal sensitive information.

- Phishing attacks: Mobile banking apps can be spoofed, leading users to enter their credentials into fake interfaces designed to steal their information.

Potential Impact

The potential impact of these vulnerabilities on the security and functionality of mobile banking apps is significant and can include:

- Unauthorized access to sensitive financial information

- Fraudulent transactions

- Compromise of user credentials

- Damage to the reputation of the banking institution

- Loss of customer trust and confidence

Threats Created by Mobile Banking App Security Vulnerabilities

Phishing Attacks:

Mobile banking app vulnerabilities can cause phishing attacks, wherein cybercriminals attempt to deceive users into providing sensitive information such as usernames, passwords, and financial data through fraudulent means.

These attacks are executed via fake websites or deceptive emails that appear to be from legitimate financial institutions, exploiting security gaps within the app to trick unsuspecting users.

Clickjacking:

Security vulnerabilities in mobile banking apps can enable clickjacking, a technique used to deceive users into clicking on malicious elements disguised as legitimate ones.

This can lead to unauthorized transactions, data theft, or the installation of malware on the user’s device, all of which can compromise the security and integrity of the app.

Man-In-The-Middle (MITM) Attacks

Mobile banking app vulnerabilities create opportunities for MITM attacks, wherein an attacker intercepts communication between the app and its servers, potentially gaining access to sensitive user data such as login credentials, account details, and transaction information.

This type of attack can occur when the app fails to implement robust encryption and secure communication protocols, leaving users’ data vulnerable to interception and exploitation.

Banking Trojan:

Security weaknesses in mobile banking apps can pave the way for banking trojans, malicious software designed to infiltrate the app and steal users’ financial information.

Banking trojans can manipulate legitimate transactions, capture sensitive data during the authentication process, or even initiate unauthorized transactions, posing a significant threat to the security and trust of mobile banking app users.

Impact on Users and Financial Institutions:

Users are exposed to the risk of financial fraud, identity theft, and unauthorized transactions, potentially leading to significant monetary losses and reputational damage.

Financial institutions face the threat of compromised customer accounts, regulatory repercussions, and erosion of trust and credibility, ultimately impacting customer retention and brand integrity.

How to secure a mobile banking app?

As a fintech app development company, it’s our responsibility to prioritize the security of mobile banking apps. Here are the best practices for ensuring the safety of your users’ financial data:

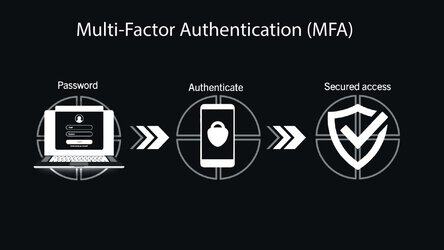

Implement Multi-Factor Authentication (MFA):

Multi-Factor Authentication (MFA) requires users to provide at least two forms of verification before accessing their accounts. This typically includes something the user knows (e.g., a password) and something the user has (e.g., a unique, one-time code sent to their mobile device).

By implementing MFA, mobile banking apps add an extra layer of security beyond passwords, making it significantly harder for unauthorized users to gain access to accounts even if the password is compromised.

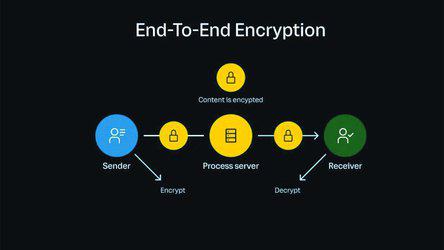

End-to-End Encryption:

End-to-End Encryption ensures that all data transmitted between the mobile app and the banking servers is encrypted. This means that even if intercepted, the data cannot be deciphered, thus protecting sensitive information such as account numbers, passwords, and transaction details. It helps to safeguard user privacy and ensure that unauthorized parties cannot access or tamper with the data being transmitted.

Regular Security Audits:

Regular security audits and penetration testing are essential to identify and address vulnerabilities in the mobile banking app. These audits involve systematically assessing the app’s security measures, identifying potential weaknesses, and addressing them before they can be exploited by attackers. By conducting regular security audits, mobile banking apps can stay ahead of potential security threats and maintain the integrity of their security systems.

Behavioral Analytics:

Behavioral analytics involves monitoring user behavior and detecting any anomalies or suspicious activities. By analyzing patterns of user behavior, the app can identify deviations from the norm that may indicate potential security breaches or fraudulent transactions. Behavioral analytics can help mobile banking apps detect unauthorized access, account takeover attempts, and other security threats in real time.

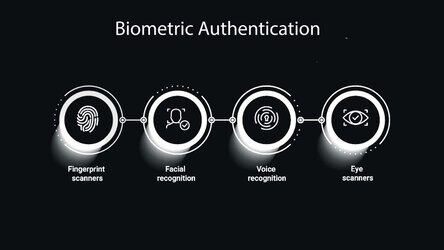

Secure Authorization and Authentication:

Secure authorization and authentication mechanisms ensure that only authorized users can access the app and perform transactions. This includes implementing strong authentication methods such as biometric authentication (e.g., fingerprint or facial recognition) and token-based authentication. These methods add an extra layer of security and help prevent unauthorized access to user accounts.

Secure Data Storage:

Secure data storage on the mobile device involves encrypting sensitive data stored within the app and ensuring that it is protected from unauthorized access. This is crucial in the event that the device is lost or stolen. By encrypting sensitive data, mobile banking apps can prevent unauthorized access to user information even if the physical device falls into the wrong hands.

User Education and Awareness:

Educating users about best practices for using the mobile banking app securely is essential. This includes advising users to avoid conducting banking activities over public Wi-Fi networks, regularly updating the app to patch security vulnerabilities, and being cautious of phishing attempts. By raising user awareness about potential security risks and best practices, mobile banking apps can empower users to play an active role in safeguarding their own security.

Enhance your Mobile Banking App Security with Mindster!

At Mindster, we are dedicated to ensuring the utmost security of your mobile banking app from the very beginning and beyond. Our approach involves integrating a comprehensive secure development lifecycle (SDLC) into your project, ensuring that security is not an afterthought but a fundamental aspect of the entire development process.

With Mindster, you’re not just receiving a mobile banking app; you’re gaining access to a secure and reliable solution. We recognize the critical nature of protecting your users’ financial data and are steadfast in delivering the highest levels of security.

- Agentic AI1

- Android Development3

- Artificial Intelligence38

- Autopay1

- Classified App3

- Custom App Development5

- Digital Transformation12

- Doctor Appointment Booking App14

- Dropshipping1

- Ecommerce Apps40

- Education Apps2

- Fintech-Apps38

- Fitness App4

- Flutter4

- Flutter Apps20

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care10

- IoT2

- Loyalty Programs11

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps132

- On Demand Marketplace1

- Product Engineering6

- Progressive Web Apps1

- React Native Apps2

- Saas Application2

- Shopify9

- Software Development3

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized7

- Web App Development1

Comments