Designing for Trust: UI/UX Principles in Fintech App Development

7 Nov 23

Fintech app development has a significant impact on the success of your company in the quickly changing world of digital transformation. Fortunately, fintech is a game-changer seeking to make bank interactions more personal.

Fintech is one of the industry’s most famous innovations, outpacing social networking (72%), video streaming (78%), and both. A visually attractive and captivating fintech app design that not only meets customers’ technical demands but also offers an intuitive user experience is essential for sustainability.

A perfect user interface (UI) and user experience (UX), along with simple and safe design features, make up a winning fintech app. However, creating a seamless UI/UX design for a fintech service that appeals to the wide range of customers that banks serve takes time!

Hence, in this blog, we will show you how UI/UX design principles impact fintech mobile apps and help create trust for fintech app development.

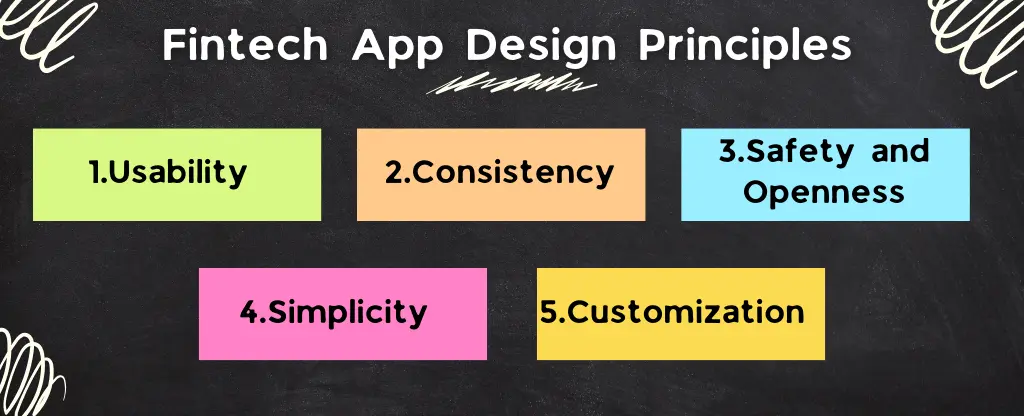

Fintech App Design Principles

A few basic ideas must be addressed and monitored as we investigate fintech app development. These ideas serve as more than just recommendations; they are the cornerstone upon which practical fintech applications are constructed.

1. Usability

A fintech application needs to be easy to use. This implies that the app’s interface must be straightforward. It’s critical to comprehend user flow, predict users’ subsequent actions, and optimize the customer experience. Active features ought to assist customers, not perplex them.

2. Consistency

Consistency is another principle that needs to be adhered to. The uniformity of design components such as color schemes, typography, and interface components guarantees the application’s competent and reliable appearance. Additionally, when consumers become accustomed to the app’s constant designs and trends, it facilitates navigation.

3. Safety and Openness

The emphasis on confidentiality and openness is arguably the most critical factor for fintech applications. When it comes to banking details, customers must trust your app, and your design should reflect that confidence.

Developing this confidence may be significantly aided by transparent design components, understandable information, and apparent safety features.

4. Simplicity

Simplicity is another design philosophy for financial applications. The user interface (UI) must be clear and straightforward, given the abundance of financial data and processes an end-user may have to manage. Excessively complicated designs have the potential to mislead consumers and impair the app’s effectiveness.

There are inevitable fundamental UI/UX design mistakes to avoid while designing FinTech mobile apps. When it pertains to financial apps, less is frequently more, regardless of whether you choose to work with a designer who specializes in UI/UX or do it independently.

5. Customization

Lastly, the visual appearance of your financial app should incorporate customization throughout. This implies that the application must be flexible to adjust to each consumer’s distinctive tastes and routines. You can significantly increase user happiness and involvement by providing a personalized user experience.

Aesthetic Attraction of Fintech App Development

Your financial app’s visually appealing design is crucial to drawing users in and holding their attention. Sometimes, appearances are overlooked in mobile app development for financial institutions, where confidentiality and efficiency come first.

Nonetheless, visually impressive and functional software may improve the user experience and differentiate itself in an overflowing marketplace.

1. Typography

Like color palettes, typography has a significant influence on your app’s functionality and aesthetic attractiveness. A well-designed typographic structure makes it easier to find what you’re searching for and leads you through the information.

It’s crucial to select typefaces that are readable and appropriate for mobile devices’ tiny screens.

2. Colour Schemes

Selecting colors for your financial app is a communication tool as much as a design choice. Colors may direct consumers through your app and elicit feelings and behaviors from them. You must master color combinations, as these are the tips for effective UI/UX design for fintech apps.

A carefully considered color scheme may improve the overall appearance of your app, increase its use, and strengthen the reputation of your business.

When selecting colors, make sure they complement each other. It’s crucial to ensure the colors you choose to complete your business’s image and connect to your intended audience.

3. Comprehensive Visual Layout

Other components of visual appeal, in addition to colors and typography, are crucial to the visual attractiveness of your application.

This covers the design, spacing, and usage of icons and graphics. To produce a visually pleasing and unified structure, all of these components should cooperate.

Integrity and Safety

Confidentiality and openness are essential in mobile app development for fintech services; they are not optional attributes. Consumers assign confidential monetary data to fintech applications; thus, the app’s design has to reflect reliability and safety.

The major technology used in current digital finance or mobile banking is the use of generative AI or blockchain technology, so that the future of financial transactions is safe and convenient.

1. Openness in Information Utilization

It is equally vital to be transparent regarding how your app gathers, keeps, and utilizes customer information.

Customers should receive explicit details on how they use their data, and any modifications to these guidelines should be made known in advance. In addition to fostering confidence, this guarantees adherence to privacy laws.

2. Safe Design Components

When designing financial software, security has to be a primary priority rather than an afterthought. This covers secure design components, including encryption, biometric authentication, password security, and safe data storage.

Customers must be able to identify and comprehend these components, which reassures them that your software is secure for their personal information.

3. Notable Safety Components

User confidence may be further increased by visible safety features like certification insignia, safe connection indications, and trust badges. These icons provide visible guarantees that using your software is risk-free.

When designing finance software, safety and openness are essential components. You may create a fintech app that not only safeguards customer information but also gains credibility through apparent safety precautions, transparent data collection practices, and encrypted design components.

There are several fintech mobile app trends that help safeguard fintech services. One such is the use of contactless payments, which helps in safer transactions while also improving their effectiveness.

Evaluation and Input from Users

Validation and customer feedback are critical phases in developing a mobile fintech app, regardless of how effectively your fintech app is designed.

They offer insightful information on how well your app fits into the needs and desires of your customers, as well as how effectively it functions in actual use.

1. Continuous Monitoring

Continuous evaluation means putting your software through its paces at different points in the building stage and modifying it according to the results.

This could involve safety testing to guarantee customer information is safe, efficiency testing to ensure the app functions well, and accessibility testing to ensure it is simple to navigate and use.

Using an iterative method, you may find and address problems before the development process, saving you time and money. It also ensures that the final outcome will be attractive, functional, and easy to use.

2. Customer Feedback

Although testing offers essential information about the technical elements of your app, user feedback lets you know what users think.

Opinions on user experience, operation, efficiency, and app aesthetics may fall under this category. App-based surveys, questionnaires, and customer interviews are a few ways user input may be gathered.

This feedback reveals customer needs and desires that you may have yet to think about, in addition to helping you find areas for development. Hence, it will lead to developing the best monetization strategies for fintech apps that work to bring in more profit.

Summing Up

Crafting a captivating and aesthetically pleasing financial application is a complex undertaking that necessitates a meticulous evaluation of several aspects. It would be best if you first had a thorough grasp of your target user base before designing an app that appeals to their requirements and tastes.

Principles such as simplicity, consistency, intuitiveness, safety, openness, and customization guide your design approach. This will ensure that the app is not only functional but also delightful to use.

In the realm of fintech mobile app development, following best practices may help you craft a fintech app that is unique in the market and appeals to your target audience. Keeping these guidelines in mind will put you on the right track for success, whether you decide to handle the design process yourself or hire a UI/UX designer.

At Mindster, we are here to help you sort out your doubts and bring clarifications to the best and most helpful fintech apps for the future. We are known as the top-rated mobile app development company, bringing mobility solutions to clients globally. We craft the best mobile app solutions through our expert UI/UX design team.

- Agentic AI1

- Android Development3

- Artificial Intelligence31

- Classified App3

- Custom App Development5

- Digital Transformation12

- Doctor Appointment Booking App14

- Dropshipping1

- Ecommerce Apps40

- Education Apps2

- Fintech-Apps37

- Fitness App4

- Flutter4

- Flutter Apps20

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care10

- IoT2

- Loyalty Programs9

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps127

- Product Engineering6

- Progressive Web Apps1

- React Native Apps2

- Saas Application2

- Shopify9

- Software Development3

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized6

- Web App Development1

Comments