An upsurge of creativity and enthusiasm has been seen in financial technology (FinTech) due to the introduction of generative AI, a subset of artificial intelligence (AI). It has the power to alter the way that fintech businesses operate. At Gitex 2023, one of the most outspoken topics is the role of AI in fintech and how it can revolutionize fintech app development.

The area of artificial intelligence has made strides over many years, but generative AI is a significant development. In contrast to other AI methods, it creates new material, including text, photos, videos, computer code, and synthetic data, by classifying and identifying data and learning from prior knowledge.

Generative AI allows companies to improve their procedures, increase effectiveness, cut expenses, and more wisely deploy resources to their core operations by leveraging this capacity to produce fresh data.

The world was exposed to artificial intelligence (AI) recently in the form of ChatGPT. This revolutionary invention has a Big Bang-like impact on almost every area of everyday life. This disruptive and creative explosion will revolutionize the globe as we understand it.

Numerous researchers predict that generative AI will significantly advance commercial sectors and industries. According to a recent McKinney analysis, Generative AI has the opportunity to create $2.6 trillion to $4.4 trillion in worth across sectors.

What is Generative AI?

A subdivision of artificial intelligence called “Generative AI” is concerned with producing fresh and unique information. In this process, models are trained to recognize characteristics in a data set before exploiting those trends to produce novel outcomes. Generative AI aims to create new, one-of-a-kind material that is consistent and creative.

Generative AI’s capacity to transcend the existing is among its main advantages. Conventional artificial intelligence (AI) algorithms rely on previously collected data for accurate projections or to produce content. Conversely, generative AI can conceive of something completely original, stretching the bounds of what is feasible.

AI’s Role in Fintech

The fintech sector can only function with AI, revolutionizing banking services. Automation is one of the significant uses of AI in finance.

Financial companies use chatbots and virtual assistants with AI to aid with fundamental banking issues, give 24/7 client service, and address enquiries. This not only boosts productivity but also strengthens the general client experience.

1. Personalized Financial Guidance:

Giving individualized financial guidance is another area in which AI is essential. By examining consumer data, AI algorithms may provide specialized advice for financial planning, spending plans, and saving objectives. This level of personalization enables people to make responsible financial choices in light of their own needs and goals.

2. Fraud Detection:

Another sector that AI has significantly impacted is identifying fraudulent activity. Machine learning algorithms can quickly and accurately analyze a lot of information, which can also spot trends and irregularities that might be signs of fraud. This aids in financial companies’ detection and prevention of fraud before it results in substantial harm.

3. Risk Assessment:

Another area in which AI excels in the financial sector is risk evaluation. The risk connected with different economic goods and investments may be evaluated using machine learning algorithms that study previous information and market movements. Well-informed choices and more precise risk evaluations are both benefits to banking organizations.

Influence of Generative AI in the Fintech Landscape

The fintech app development sector might undergo many revolutions due to generative AI. It may aid businesses in streamlining procedures, enhancing client loyalty, reducing risks, and improving decision-making processes.

Fintech firms may streamline complicated operations that were traditionally time- and resource-consuming through generative AI. For instance, generative AI algorithms can produce financial data, examine market developments, and spot investment possibilities dynamically. Time is saved, and the opportunities for human error are decreased.

Improving customer engagement is a primary concern for financial businesses, and generative AI may significantly contribute to this goal.

Generative AI systems may provide personalized suggestions and offerings by examining consumer information and choices, increasing customer satisfaction and loyalty. Your fintech app can be integrated with the customer loyalty program to be more user-friendly and straightforward.

Generative AI can have a substantial influence on minimizing risks. Generative AI systems may identify potential threats and irregularities in real time by continually analyzing market information and tracking activities.

Due to this, financial institutions can effectively prevent deceit, laundering of cash, and other financial crimes. Additionally, generative AI can improve the financial industry’s decision-making processes. Generative AI systems can offer insightful analysis and predictions by looking for patterns in enormous amounts of data.

This aids financial organizations in making wise choices about their money, developing goods, and company strategies.

In general, generative AI’s inclusion in the financial sector creates novel opportunities for growth and creativity. The potential of generative AI can help fintech organizations remain ahead of the competition, develop innovative products and services, and offer tremendous value to their consumers through intuitive fintech mobile apps.

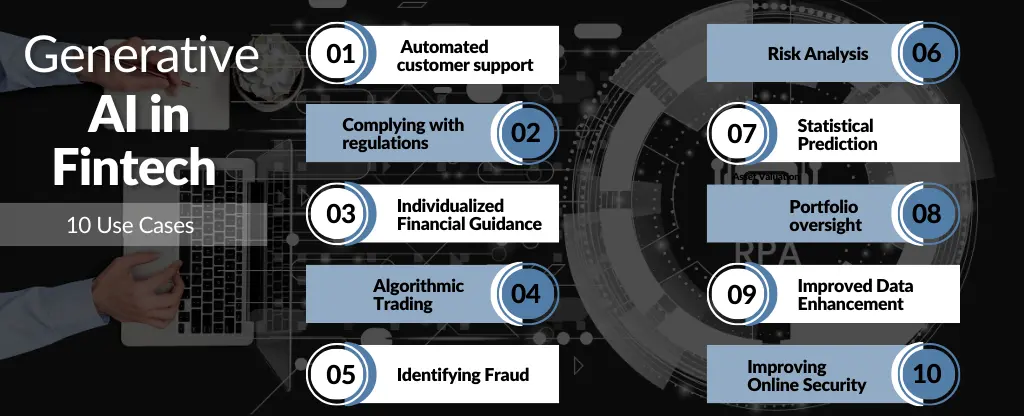

10 Use Cases of Generative AI in Fintech

Incorporating generative AI has enormous potential advantages for fintech’s. This state-of-the-art technology has the potential to revolutionize several customer support processes, improve personalized suggestions, and allow promotional efforts to be scaled.

Researching investments is one field where generative AI has a lot of potential. It can help expert traders and financial professionals make well-informed selections by quickly producing various situations and triggering their results. The secret is to use large language models (LLMs) trained on pertinent data to create valuable indications.

Furthermore, generative AI may be useful for critical financial analysts in the capital market and governance. It would be easier to complete tasks and produce trustworthy outcomes in these domains if there was access to LLMs trained precisely in rules and financial papers.

Let’s examine the most prominent generative AI use cases in the financial sector, demonstrating their potential worth and advantages.

1. Automated customer support

Automating customer care procedures, including chatbots and virtual assistants, is possible using generative AI. Generative AI may offer personalized replies and support to client inquiries by comprehending natural language and context, enhancing customer happiness and lightening the pressure on customer care employees.

2. Complying with regulations

For fintech businesses, following financial rules is essential. Generative AI can analyze legal guidelines and locate probable flaws or breaches in banking procedures. Companies may avoid fines and keep government agencies’ trust by ensuring they follow regulations.

3. Individualized Financial Guidance

Generative AI can analyze customer information, financial objectives, and willingness to take risks to offer individualized financial advice. By considering various variables and offering personalized suggestions, generative AI may assist people in making informed choices about investments, savings, and money management.

4. Algorithmic Trading

Algorithmic trading may make judgements in an instant by analyzing market data, seeing trends, and using generative AI. Businesses may automate trading operations and execute transactions based on information-driven conclusions by using the potential of generative AI, which will increase their productivity and revenue.

5. Identifying fraud

Since it helps shield consumers and companies from cash losses, identifying fraud is crucial to the fintech sector. Generative AI may analyze vast amounts of data and spot trends that point to illegal activity. Businesses may avoid monetary damages and preserve client confidence by spotting deception instantaneously.

6. Risk Analysis

In the fintech sector, risk evaluation is vital. The risk involved in investment decisions and transactions may be evaluated using generative AI by analyzing historical data, market movements, and other pertinent aspects. Practical risk assessment enables businesses to make informed choices and reduce potential expenses.

7. Statistical Prediction

To develop forecasts about numerous financial factors, including stock markets, economic conditions, and buying habits, generative AI may study previous information and industry patterns. Businesses may use predictive analysis to make data-driven choices and anticipate market changes.

8. Portfolio oversight

By examining market trends, investment tactics, and risk factors, generative AI may help manage portfolios. Giving investors real-time data and suggestions, generative AI can help investors optimize their investments and make wise choices when investing.

9. Improved Data Enhancement

Generative AI enhances the fintech sector’s current database, boosting the information accessible for development and verification. Generative AI assists in moving beyond restrictions brought on by insufficient or unbalanced datasets by producing artificial data points.

This application enhances the efficacy and of AI models by broadening the training information and assuring more robust generalizations to everyday situations.

Fintech organizations can create more precise forecasts, spot abnormalities, and perform better risk analysis with improved data augmentation.

10. Improving Online Security

Generative AI strengthens the digital foundation of financial technology, protecting it from various dangers and weaknesses.

Applications include DDoS defence, DNS security, PKI-based identification, blockchain security, and cybersecurity. Businesses may strengthen their defenses and guarantee the confidentiality and security of critical financial information by utilizing generative AI capabilities.

Using two-factor authentication and natural language processing (NLP), generative AI also helps to improve user authorization, secure cryptocurrency ecosystems, and optimize conversational platforms.

Wrapping Up

Generative AI has changed the fintech landscape by providing creative ideas and improving several facets of financial technology. The 10 use cases we have examined demonstrate the tremendous advantages of generative AI. This revolutionary technology will restructure the future of fintech as the sector develops further.

You’ll be pleasantly surprised to learn that Mindster can revolutionize your financial experience in many other ways. Mindster offers a novel level of value, from mobile app development to web app development.

We are a top-rated mobile app development company with over 13 years of experience creating beautiful and user-friendly mobile app solutions for clients worldwide with the help of our talented and driven UI/UX design team and developers.

We are cutting-edge artists using technical brilliance to promote revolutionary transformations at the corporate level; we are not simply another fintech app development company.

Ankitha is a professional content writer with more than four years of experience. She writes blogs relevant to the services that we provide and also about the various mobile app solutions that we provide. With strong research skills and critical thinking skills, she can develop high-quality content that is valid and authentic. She also has good communication skills to interact with the team members to build up-to-date content related to the latest technologies.