How Non-Bank Companies Achieve Financial Inclusion through Banking-as-a-Service?

14 Jun 23

Importance of Banking as a Service, or BaaS, is another fintech innovation allowing for banking and fintech synergy. The importance of Banking as a Service is becoming a crucial factor in the fintech industry due to digital transformation’s significant impact.

Digital transformation enables easy data access, resulting in transparency and enhanced customer satisfaction.

Technological innovation gives legacy systems transparency to SMEs and third parties, and customers sometimes get direct access to data. The BaaS platform has evolved into a critical element of open banking in financial institutions.

This is where organizations provide additional alternatives for financial transparency by opening up their APIs to third parties to create novel services.

According to a Gartner assessment, BaaS will gain widespread use in the following couple of decades.

- By the end of 2024, 30 % of banks with capital of at least $1 billion are expected to have implemented BaaS to increase income.

- Banking as a service software development is among the most profitable industries to invest in.

- BaaS providers are the ones focused on the value chain and experiencing surpassing profits.

Significance of BaaS

Fintech and digital banks challenge conventional financial systems. However, legacy banks use BaaS to transform this potential threat into a great opportunity.

To advance financial inclusion, the World Bank, the US, and the EU have worked to widen the possibilities for conventional bank accounts. Even though fewer adults now have bank accounts, these programs need help.

They inaccurately believe that having access to a conventional bank account eliminates financial isolation. Nevertheless, it is likely, many who are under or unbanked might not want bank accounts for any reason.

According to Financial Conduct Authority research, 56.2% of Americans without a bank account say they have no intention of getting one and similar patterns may also be seen in other nations.

The positive aspect is that there are no other financial service providers besides conventional banks and fintech organizations. In addition, there are other ways for consumers to get into the banking system besides possessing a bank account.

The unbanked and underbanked now have the chance to join the financial landscape individually and follow their unique requirements and experiences through the development of BaaS (banking-as-a-service).

You can learn everything about the importance of banking-as-a-service technology in this article, including how non-bank companies achieve financial inclusion through Banking-as-a-Service.

What is Banking-as-a-Service (BaaS)?

Through APIs (Application Programming Interfaces), the breakthrough platform called Banking as a Service (BaaS) gives third-party businesses and developers access to a monetary institution’s essential banking systems and services.

Because of this, nonbank enterprises develop and provide their clients with cutting-edge financial products. Additionally, it also serves without spending a fortune setting up and managing their financial facilities.

By giving third-party entities greater visibility into banking information and amenities, the importance of Banking as a Service promotes financial openness and spurs innovation, making it a vital element of the open banking movement.

BaaS facilitates the development of distinctive and focused solutions. This is possible sooner by fusing non-banking companies with controlled financial facilities. Robust BaaS solutions can open the door for improved teamwork and customer-focused finance solutions.

3 Elements of BaaS

- Banking License: Possessing a banking license that may be used to provide monetary services constitutes one of the essential components of delivering banking as a service.

- Technological Amenities: A robust technology infrastructure is critical for the BaaS framework. This is where banking comes in, offering the required technical assistance.

- Diverse Service Possibilities: The BaaS model gives people multiple possibilities and alternatives for their financial requirements.

Why is BaaS Crucial for Fintech?

Recent sources claim that the California-based BaaS business Synectra has secured $15 million in investment. The enterprises use these funds to develop their Banking as a Service platform to serve new FinTech use cases and global markets.

You can see how investment in BaaS software for customers has effective business potential by looking at Synectra’s expanding income stream.

A revolutionary invention for the financing industry is embedded finance. It involves putting banking services into diverse ecosystems, which might alter how banks run their businesses.

Banks may create new income streams by making their services available to new participants through BaaS. Further, they also improve their entire banking experience, increasing the effectiveness and efficiency of banking.

Banks may provide their consumers with:

- Real-time

- Personalized product recommendations

- Utilization of data collection and machine learning

Additionally, insurance firms carry out more thorough credit analyses to lower risk. This combination boosts productivity and efficacy, creating an array of options in the banking industry.

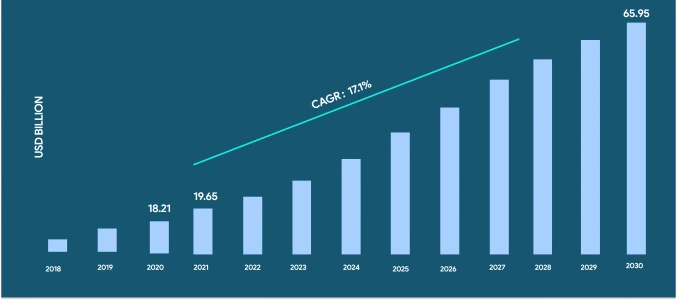

Grand View Research estimates that the BaaS market was worth $19.65 billion in 2021 and is foreseen to progress at a CAGR of 17.1 % between 2021 and 2030.

The growing need for banking services, intensifying digitalization, and widespread use of Application Programming Interfaces (APIs) are all contributing factors to the expanding market size.

These escalating BaaS trends jointly foresee the rise of customer interest in the service and the ways in which nonbank organizations might use BaaS solutions to achieve a competitive advantage in the changing financial landscape.

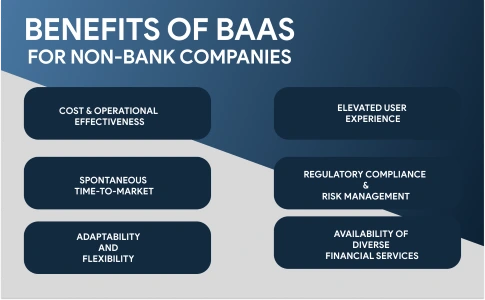

Benefits of BaaS for Non-bank Companies

The importance of Banking as a Service (BaaS) allows non-bank companies to expand effectively, increase client satisfaction, widen offerings, save costs, and quicken time to market.

By utilizing BaaS solutions, these businesses may take advantage of fresh business opportunities, encourage diversity, and provide more clients with access to financial services. The numerous advantages of banking as a service for nonbank organizations include the following:

- Cost & Operational Effectiveness

- Elevated User Experience

- Spontaneous Time-to-Market

- Adaptability and Flexibility

- Regulatory Compliance & Risk Management

- Availability of Diverse Financial Services

Let’s dive into the description of each benefit.

Cost & Operational Effectiveness

Two of the most significant use cases for Banking as a Service are cost reduction and operational effectiveness.

BaaS solutions allow nonbank businesses to steer clear of the costs and time-consuming processes involved in creating and upholding a fully functional banking infrastructure, often leveraging finance automation to streamline operations and reduce overhead.

These solutions reduce the need for expensive infrastructure construction, licensing, and adherence to regulations, which saves a lot of money. This enables nonbank businesses to concentrate on their primary expertise.

Elevated User Experience

Among the increasingly demanded banking as a service applications is improved client experience. With the help of the BaaS model, nonbank businesses may quickly provide financial services to their clients.

By incorporating banking features into their current systems, they can give clients an extensive user experience and meet their monetary requirements without referring them to other banking services.

Spontaneous Time-to-Market

The importance of Banking as a Service and APIs, nonbank firms may hasten their entrance into the finance industry.

They may swiftly create and market their financial goods or services using resources. As a result, they won’t need to start from zero while building their economic infrastructure.

Adaptability & Flexibility

Platforms for banking as-a-service offer flexible options that address the varying demands of nonbank organizations.

Nonbank enterprises may grow their business operations without making significant capital expenditures through the adaptability of cloud-based banking as a service solutions.

BaaS providers can manage higher levels of transactions and assist in developing emerging markets with a growing client base.

Regulatory Compliance & Risk Management

BaaS partnerships with reputable banks benefit nonbank businesses from robust compliance and risk management solutions.

These businesses may rely on the bank partnerships’ knowledge of complex regulatory standards to manage them, ensuring conformance and lowering the possibility of fines or negative publicity.

Availability of Diverse Financial Services

Through partnerships with well-established banking organizations, nonbank businesses may access their facilities and experience.

This is to provide a range of banking services, such as payments, transfers, and savings accounts. This enables nonbank organizations to increase the range of products they offer and the value they deliver to customers.

Regulatory Factors for BaaS Use

The regulations and compliance issues that nonbank enterprises must consider when adopting Banking-as-a-Service solutions are included in the legal issues involved in BaaS adoption.

These factors are essential for maintaining compliance with the regulations and rules that apply, allowing businesses to function within the limitations of the banking sector.

License Requirements

Nonbank organizations must consider the legal constraints and licensing needs of offering banking services via BaaS.

Depending on the government’s authority, nonbank enterprises may need different licenses to comply with the rules.

Data Safety & Confidentiality

When working with confidential financial information in BaaS, following confidentiality regulations like GDPR, CCPA, and PCI-DSS is crucial. Specific security processes must be put in place to protect customer data.

Anti-Money Laundering (AML) & Know Your Customer (KYC)

Nonbank businesses follow these requirements to stop money laundering incidents and confirm their clients’ identities. Achieving this aim requires developing efficient verification methods and keeping precise documentation.

Client Security

Businesses must abide by laws that protect customers to ensure ethical business practices, openness, and efficient dispute settlement processes.

Cross-Border Restrictions

Nonbank firms must manage cross-border rules when providing BaaS services throughout numerous countries.

This entails being aware of every jurisdiction’s regulatory needs, abiding by international banking legislation, and taking care of any unique constraints or duties.

Legislative Changes

Nonbank enterprises must remain up-to-date on governmental developments to guarantee conformity and reduce potential liabilities.

How to Build a BaaS Platform?

It takes expertise in financial services development, safety, and accountability to create a BaaS software solution.

It is possible to streamline the development process and ensure the success of your BaaS enterprise by collaborating with skilled programmers and sector specialists.

- Establish the specifications and scope

- Select a stack of technologies

- Create essential banking features

- Guarantee legality and safety

- Create logical user interfaces

- QA and testing

- Track and execute

- Maintain and offer continuing assistance

Each of these steps can be discussed in detail.

Establish the Specifications & Scope

Start by stating the goals and parameters of your BaaS software application. You can work to decide which financial services you want to provide, such as handling accounts, transactions, loans, or conformity.

Furthermore, you can carry out in-depth market research to pinpoint your target market and fully comprehend your demands, guaranteeing that the approach to growth aligns with your company’s objectives.

Select a Stack of Technologies

According to your specifications, security, reliability, and connectivity demands, choose the best technology stack during this step.

To create a solid and sustainable BaaS platform, our knowledgeable team considers elements like programming languages, platforms, databases, and cloud infrastructure.

Create essential banking features

Put your BaaS software solution’s basic banking features into place during this phase. This includes strong security for users, setting up accounts, processing payments, and reporting functionalities.

To maintain a reliable and legal system, prioritize compliance with financial industry norms and government regulations across the development process.

Guarantee Legality and Safety

To protect valuable customer information and money transactions, prioritize developing robust safety protocols. Besides, implement encoding, multi-factor authorization, and safe data storage procedures during this step.

We provide you and your customers with a secure and legal BaaS platform by ensuring strict compliance with legal requirements, including KYC (Know Your Customer), AML (Anti-Money Laundering), and data protection legislation.

Create Logical User Interfaces

In this stage, design user-friendly interfaces for the administrator and the consumer. We strongly emphasize providing an effortless user experience, ensuring simple navigation, and simply and succinctly presenting financial services and data.

QA & Testing

The most effective quality control procedure includes thoroughly testing your BaaS software solution to find and fix any flaws or problems. Thorough working, safety, efficiency, and user testing must be conducted.

These tests guarantee your platform’s reliability, dependability, and extensibility, ensuring a smooth and effective interaction between consumers and management.

Track & Execute

Regardless of whether it’s cloud servers or on-premises servers, implement your Banking as a Service software solution during this step on the chosen infrastructure.

We assiduously monitor the system’s efficiency, safety, and user input to ensure optimal operation. Furthermore, we encourage continuous development by upgrading and improving the application frequently to keep up with changing customer demands, economic conditions, and changes in the law.

Maintain & Offer Continuing Assistance

To guarantee the smooth running of your BaaS platform, offer trustworthy maintenance and support services.

The committed staff ensures your software is current and safe by being informed of industry developments, security updates, and regulatory updates.

Summing Up

The importance of Banking as a Service is highlighted through this blog. This operation model is quite essential in the modern digital world.

It allows businesses to obtain financial information about their clients, allowing them to develop specialized services and goods. Additionally, it enables digital-only financial services, increasing the business’s visibility and customer base.

Through a wide marketplace of financial goods and concepts, banking as a service is a viable and reliable approach to drawing in and keeping customers. In this cutthroat environment, the nonbank enterprises with the most alluring and efficient platforms will come out on top.

- Agentic AI1

- Android Development3

- Artificial Intelligence37

- Classified App3

- Custom App Development5

- Digital Transformation12

- Doctor Appointment Booking App14

- Dropshipping1

- Ecommerce Apps40

- Education Apps2

- Fintech-Apps38

- Fitness App4

- Flutter4

- Flutter Apps20

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care10

- IoT2

- Loyalty Programs10

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps130

- On Demand Marketplace1

- Product Engineering6

- Progressive Web Apps1

- React Native Apps2

- Saas Application2

- Shopify9

- Software Development3

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized7

- Web App Development1

Comments