Unleashing The Potential Of Blockchain In Developing Fintech Apps

4 Dec 24

The fintech apps has evolved considerably with the integration of blockchain technology. It can increase revenue, enhance the end-user experience, streamline delivery, increase efficiency, and lower business risk.

Compared to any other IT sector, Fintech is still developing. Every day, several novel finance apps emerge that provide improved and innovative methods for processing and managing payments.

Blockchain has changed every requirement, particularly how currency is transacted and the way secretly funds are generated. But will this technology substitute or complement the current banking sector? Blockchain is one of the most incredibly prevalent subjects in business and education.

What is Blockchain Technology?

Have you ever noticed the term Blockchain technology?

Blockchain technology is a sophisticated database mechanism allowing for transparent and straightforward sharing around a business network. Data is stored in blocks in a blockchain database connected in a chain.

The data is chronologically compatible. This is because you cannot edit or delete the chain without permission from the connections.

You can set up an unchangeable or immutable ledger using blockchain technology for handling payments, settlements, user accounts, and other interactions.

A typical picture of these transactions is consistent with the system’s built-in features, which also stop unauthorized transaction submissions.

Importance of Blockchain Technology in the Fintech Industry

For storing money transactions, conventional database methods present some difficulties. Take the sale of an asset, for instance. The property belongs to the purchaser when the payment has been exchanged.

The purchaser and the vendor can independently keep track of financial activities, but either source can be relied upon. Additionally, they may argue that they have handed over the money even when they haven’t, and both parties can readily deny doing so.

Transactions are monitored and verified by a responsible third party to prevent potential legal problems. The transaction is made more difficult by the presence of this centralized authority, which also creates a weak point. Both parties may be harmed if the primary database is accessed.

By creating a decentralized, immutable system for payment documentation, blockchain solves these issues. For real estate transactions, blockchain creates independent ledgers for the buyer and the seller.

Each transaction thus becomes open to the consent of both parties and is displayed in real time on their records.

Any tampering with earlier transactions will destroy the entire ledger. Blockchain technology has proven valuable in a variety of businesses, notably the creation of digital currencies like Bitcoin, owing to these properties.

Impact of Blockchain on the Fintech Industry

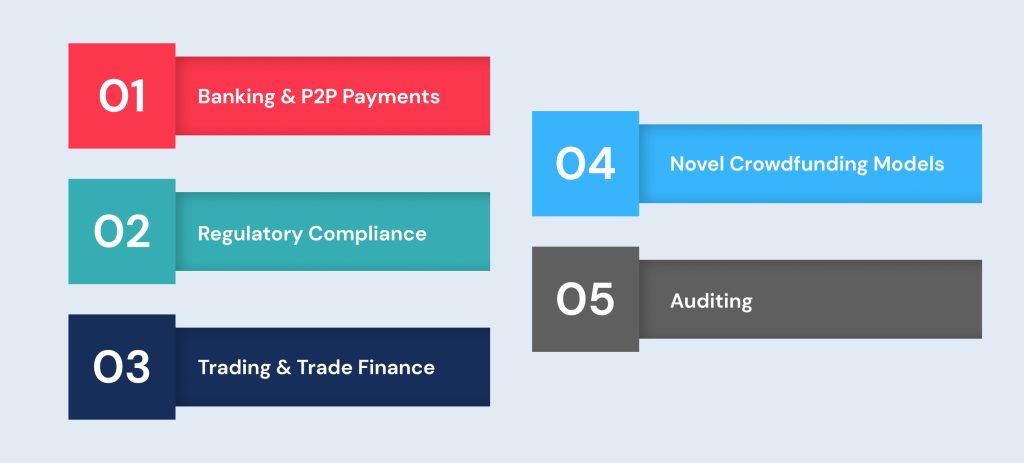

Focusing on the critical sectors of the global economy is an effective method to analyze and comprehend the influence of blockchain technology on Fintech apps.

Let us now consider the significant impacts of Blockchain technology in the fintech industry.

Banking & P2P Payments

In most banking settings, there is excessive bureaucracy and ambiguous incompetence, and these issues are prevalent in the banks’ payment processing and settlement areas.

These gaps can be eliminated if a decentralized system adheres to various consensus methods for speedier transactions, such as blockchain technology. These gaps are due to outdated banking techniques and the role of hierarchy at several levels.

Banks are now mindful of the genuine advantages that blockchain technology (the use of digital currencies) has over conventional currencies, such as cheaper transaction costs, quicker transactions, etc.

This convinces all financial institutions worldwide to investigate the possibilities of switching to digital currency and looking into blockchain fintech solutions.

Regulatory Compliance

Fintech organizations are embracing blockchain to improve compliance with regulations. This is because it is projected that there will be an increase in demand for regulatory services globally in future decades.

To avoid the need for authorities to verify the document’s legitimacy, they depend on such technology to monitor every validated trade. The technology also keeps track of all the actions made by the related people.

Technology enables regulators to examine the original paperwork rather than numerous copies.

The enduring nature of the blockchain has an opportunity to reduce the likelihood of errors and ensure the accuracy of records used for accounts payable and audits. It can also reduce the time and expense associated with accounting and auditing services.

Trading & Trade Finance

Trade finance still depends on uploaded files, faxed, and disseminated worldwide to confirm information. Purchases of stocks and shares still involve a laborious process of brokerage, exchanges, clearing, and settlement.

Settlement typically takes three days, but weekends may be added if necessary. Each trader must keep separate databases for all payment-based documentation and frequently cross-check them for authenticity.

By incorporating blockchain technology into financial services in this industry, dealers can avoid onerous counterparty checks, and every process step can be optimized. This lowers the risks involved, expedites development, and improves trading correctness.

Novel Crowdfunding Models

The crowdfunding method aims to raise income by appealing to many individuals, typically online, for a modest amount of cash.

In contrast to conventional funding strategies, financing on the blockchain is entirely open and much faster due to ICOs, IEOs, and other methods.

Auditing

Accounts are verified by auditing, which also identifies any irregularities. The procedure is slow in addition to being complicated. Blockchain, though, makes the procedure simpler.

With technology, you can request that the blockchain application development business you’ve worked with add the record straight to the ledger. This provides a quick and practical approach to updating data.

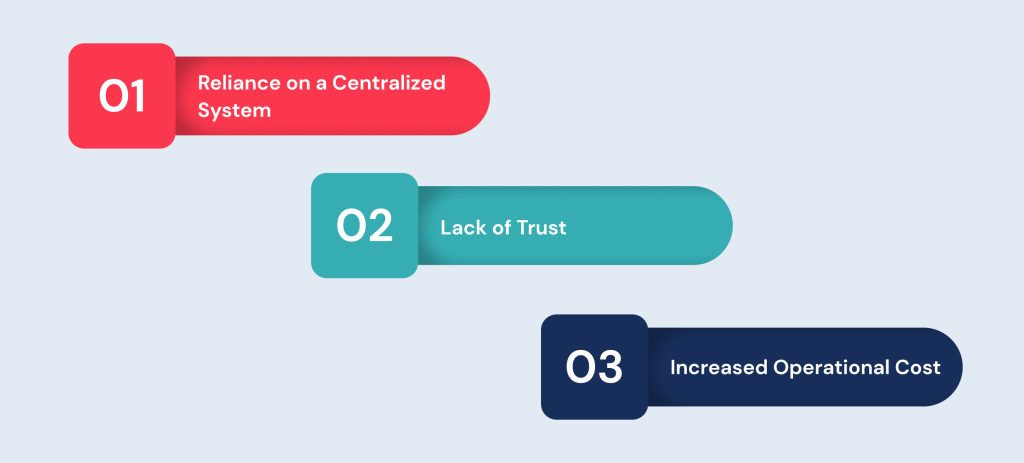

Challenges of Blockchain in the Fintech Industry

Reliance on a Centralized System

Fintech apps may seem convenient, but outside parties hold absolute authority. Users continue to wait for an acknowledgement in their favour, while more senior officials only accept the payments.

Lack of Trust

Users have no idea what is happening in the background of fintech applications when they take any activity.

This causes a lot of uncertainty and increases people’s fear regarding identity fraud, ultimately undermining their confidence in the system. With openness and consistency, blockchain technology solves this financial problem.

Increased Operational Cost

When it comes to Fintech, time equals wealth. Therefore, blockchain technology continues to demonstrate as one of the fintech innovations that may lower the cost by more than fifty percent.

It does this by removing the reliance on numerous people, keeping the procedure accessible to all, and shortening the duration required.

Blockchain in the Fintech Sector: What the Future Holds

A revolution sparked by the development of blockchain technology will assist in getting rid of some of the drawbacks of conventional banking.

Building on the ideas of equity and decentralization, blockchain in the fintech sector may offer us a banking option that is much more frictionless and efficient.

If this is your need, contact our mobile app development company for building a better fintech app that marks the best in the industry.

- Agentic AI1

- Android Development3

- Artificial Intelligence37

- Classified App3

- Custom App Development5

- Digital Transformation12

- Doctor Appointment Booking App14

- Dropshipping1

- Ecommerce Apps40

- Education Apps2

- Fintech-Apps38

- Fitness App4

- Flutter4

- Flutter Apps20

- Food Delivery App5

- Grocery App Development1

- Grocery Apps3

- Health Care10

- IoT2

- Loyalty Programs10

- Matrimony Apps1

- Microsoft1

- Mobile App Maintenance2

- Mobile Apps131

- On Demand Marketplace1

- Product Engineering6

- Progressive Web Apps1

- React Native Apps2

- Saas Application2

- Shopify9

- Software Development3

- Taxi Booking Apps7

- Truck Booking App5

- UI UX Design8

- Uncategorized7

- Web App Development1

Comments