UPI AutoPay is the only payment infrastructure that can scale subscription businesses to India’s 800+ million digital payment users—but implementation requires precise technical integration, regulatory compliance, and UX optimization to avoid the 40%+ churn rates plaguing subscription apps.

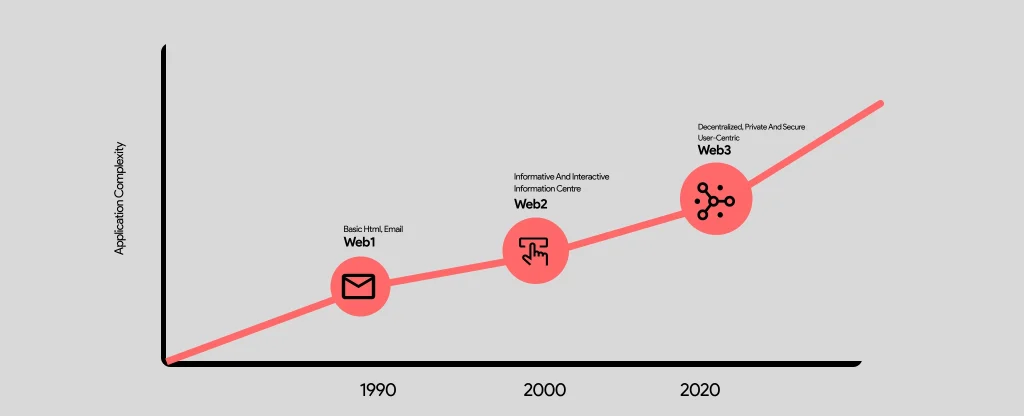

The UPI AutoPay feature rollout has created a $374.24 billion opportunity by 2033. India processes 640 million UPI transactions daily—84% of all digital payments. Credit card penetration remains at 8%, making UPI AutoPay the only viable recurring payment method for mass-market subscription business models.

Key fact: UPI supports mandates up to ₹15,000 (₹1,00,000 for specific categories like mutual funds and insurance), covers 350+ million users, and offers lower transaction costs than cards.

India’s Subscription Market

India’s subscription e-commerce market will grow from USD 10.34 billion (2024) to USD 374.24 billion by 2033 (45.13% CAGR). 783 million smartphone users as of 2024.

Subscription business models in use: flat-rate subscriptions, tiered pricing (basic/premium/enterprise), usage-based models, freemium conversions, and hybrid approaches. Sectors include personal care, food delivery, fitness, education, and fintech.

UPI AutoPay Overview

Launched by NPCI on July 22, 2020. Enables recurring payments through UPI apps without credit cards or NACH mandates.

Key Features of UPI AutoPay

Seamless Mandate Creation: Users can create recurring payment mandates instantly through any UPI app like Google Pay, PhonePe, Paytm, or Amazon Pay. The setup is as simple as scanning a QR code, entering a UPI ID, or clicking a UPI link.

Flexible Payment Schedules: UPI AutoPay supports multiple frequency options including daily, weekly, fortnightly, monthly, bi-monthly, quarterly, half-yearly, and yearly payments. This flexibility allows businesses to design subscription models that align with their service delivery.

Transaction Limits: The feature supports mandates up to ₹15,000 without additional authentication for each transaction. For specific merchant categories (including mutual funds, insurance, and credit card payments), the limit extends to ₹1,00,000 per transaction—a significant increase announced by RBI to encourage higher-value subscriptions.

Secure Authentication: UPI AutoPay requires UPI PIN authentication for mandate creation, modification, and revocation. For mandates under ₹15,000, only the first payment requires PIN entry. For higher amounts, users authenticate each transaction with their UPI PIN.

User Control: Customers retain complete control with the ability to modify, pause, or revoke mandates at any time directly from their UPI app. This transparency builds trust and reduces subscription anxiety.

Pre-notification: Users receive notifications 24 hours before each scheduled payment, ensuring they’re always informed and can take action if needed.

Why UPI AutoPay for Subscriptions

Market Reach: 640 million daily UPI transactions, 84% of digital payments in India. Accesses users without credit cards.

Lower Costs: UPI transaction fees lower than credit card processing fees.

Target Demographics:

- Young professionals without credit cards

- Students

- Rural and semi-urban users with bank accounts

- Insurance buyers preferring monthly premiums

Implementation by Sector

OTT Platforms: Netflix, Disney+ Hotstar, SonyLIV, Gaana use UPI AutoPay for subscriptions without credit card requirements.

Insurance & Mutual Funds: Monthly premium payments and SIP automation. ₹1,00,000 transaction limit applies.

EdTech: Testbook and similar platforms use periodic payment cycles for course access.

SaaS/Cloud: AWS accepts UPI for Indian customers with automated monthly billing.

E-commerce: Subscription boxes and rental services use it for demographics without credit cards.

Non-Profits: Recurring donation automation.

Technical Implementation: Getting Started

Understanding how to integrate UPI AutoPay into fintech apps and e-commerce platforms is crucial for capturing the growing subscription market. Whether you’re building a fintech app for investment management, a lending platform, or an e-commerce subscription service, the integration process follows a similar framework with some sector-specific considerations.

Choosing a Payment Gateway

Several payment service providers in India offer robust UPI AutoPay integration:

Razorpay: Offers a single integration for all recurring payment modes, including UPI AutoPay, with simple API implementation and excellent documentation.

Cashfree Payments: Provides superior automation, customizable checkout experiences, and the ability to create and update up to 10,000 subscriptions in bulk.

Paytm: Offers integrated UPI AutoPay solutions with high success rates and extensive merchant support.

Other Options: Recurly with Ebanx, UnPay, and various banking partners also provide UPI AutoPay capabilities.

How to Integrate UPI AutoPay in Fintech Apps

Fintech applications have unique requirements when implementing UPI AutoPay, particularly around regulatory compliance and user trust.

For Investment Platforms (Mutual Funds, Stocks, Gold):

- Integrate UPI AutoPay for SIP (Systematic Investment Plan) payments

- Leverage the higher ₹1,00,000 transaction limit available for mutual fund mandates

- Implement automatic portfolio rebalancing triggers based on successful mandate executions

- Provide investment tracking dashboards that correlate with mandate schedules

- Ensure SEBI compliance for all recurring investment transactions

For Lending and Buy Now Pay Later (BNPL) Apps:

- Use UPI AutoPay for EMI (Equated Monthly Installment) collections

- Integrate credit scoring checks before mandate creation

- Implement early payment options with mandate modification capabilities

- Build dunning workflows for failed payment scenarios

- Ensure RBI compliance for digital lending practices

For Insurance Tech Platforms:

- Leverage the ₹1,00,000 limit for premium payments

- Integrate policy issuance with successful first mandate execution

- Provide grace period management for failed premium payments

- Implement renewal reminders synchronized with mandate schedules

- Comply with IRDAI regulations for digital policy issuance

For Digital Wallets and Neo-Banks:

- Offer UPI AutoPay as a value-added service for users

- Implement top-up automation for prepaid instruments

- Build bill payment automation for utilities

- Provide spending analytics based on recurring payment patterns

How to Integrate UPI AutoPay in E-commerce Apps

E-commerce platforms require different integration approaches based on their business model.

For Subscription Box Services:

- Implement flexible delivery schedules aligned with payment frequencies

- Allow users to skip deliveries without canceling mandates

- Build inventory prediction models based on active mandates

- Provide customization options for each delivery cycle

- Integrate logistics tracking with payment schedules

For Grocery and Daily Essentials Platforms:

- Offer scheduled deliveries with automatic payment

- Implement dynamic basket modification before each payment cycle

- Build smart reordering based on consumption patterns

- Provide price protection guarantees for subscribed items

- Handle out-of-stock scenarios gracefully with prorated refunds

For Media and Content Platforms:

- Implement tiered access based on subscription status

- Build content recommendation engines that showcase subscription value

- Provide download quotas that reset with successful payments

- Offer family sharing plans with consolidated billing

- Handle content licensing changes transparently

For SaaS E-commerce Tools:

- Integrate usage metering with subscription payments

- Implement automatic scaling of service limits based on plan

- Provide detailed usage analytics and cost forecasting

- Build developer-friendly APIs for subscription management

- Offer white-label subscription solutions for marketplace sellers

Integration Steps

- Set Up Merchant Account: Register with a payment gateway that supports UPI AutoPay and complete KYC requirements.

- API Integration: Implement the subscription and mandate creation APIs provided by your payment partner. Most gateways offer SDKs for popular platforms.

- Design User Flow:

- Present UPI AutoPay as a payment option during checkout

- Collect mandate details (amount, frequency, start date, validity)

- Send authorization request to user’s UPI app

- Handle mandate approval callbacks

- Webhook Implementation: Set up webhooks to receive real-time updates on mandate status, successful payments, failures, and user actions.

- Testing: Use sandbox environments to test various scenarios including mandate creation, scheduled payments, failures, modifications, and revocations.

Key Technical Considerations

VPA Handling: UPI requires passing the Virtual Payment Address (VPA) through the payment gateway. Ensure your integration correctly handles VPA collection and transmission.

Net Terms Configuration: Set net terms to 0 to avoid failed payments due to limited UPI charge windows (12 AM – 7 AM IST).

Mandate Amount Calculation: For variable pricing, carefully calculate maximum mandate amounts considering base plan amounts, taxes, and potential price changes.

Price Change Management: UPI mandates don’t support direct price changes. If subscription prices change, the existing mandate must be canceled and a new one created with customer consent.

Retry Logic: Implement intelligent retry mechanisms. UPI AutoPay payments can be retried within the same day during the designated retry window.

Error Handling: Build robust error handling for various failure scenarios including insufficient balance, mandate expiry, user cancellation, and technical issues.

Regulatory Compliance: Meeting Indian Payment Standards

When implementing UPI AutoPay, regulatory compliance is non-negotiable. Businesses must adhere to guidelines set by the Reserve Bank of India (RBI), National Payments Corporation of India (NPCI), and relevant data protection laws.

RBI Compliance Requirements:

- Ensure proper customer authentication for mandate creation

- Maintain transparent disclosure of subscription terms, amounts, and frequencies

- Implement secure data handling practices for customer financial information

- Follow the RBI’s guidelines on recurring transactions and e-mandates

- Adhere to transaction limit restrictions (₹15,000 for general categories, ₹1,00,000 for specific merchant categories)

NPCI Guidelines:

- Register as a merchant with NPCI-approved payment service providers

- Follow NPCI’s technical specifications for UPI AutoPay implementation

- Ensure mandate execution only during the permitted time window (12 AM – 7 AM IST)

- Implement proper notification mechanisms as per NPCI standards

- Maintain audit trails for all mandate-related activities

Data Protection and Privacy:

- Comply with India’s Digital Personal Data Protection Act, 2023

- Implement end-to-end encryption for sensitive payment data

- Obtain explicit user consent before creating mandates

- Provide users with easy access to their data and mandate history

- Ensure secure storage and transmission of Virtual Payment Addresses (VPAs)

Consumer Protection:

- Display clear refund and cancellation policies

- Provide easy mandate modification and cancellation options

- Send pre-debit notifications as required

- Maintain customer support channels for payment-related queries

- Document and resolve disputes in accordance with RBI guidelines

For Fintech Apps: Additional compliance requirements may include SEBI regulations for investment platforms, IRDAI guidelines for insurance products, and specific KYC requirements.

For E-commerce Platforms: Ensure compliance with consumer protection laws, clear communication of subscription terms, and proper handling of failed payment scenarios to prevent service disruptions.

Best Practices for UPI AutoPay Implementation

1. Clear Communication

Transparency is crucial for subscription success. Clearly communicate:

- Exact amount to be debited

- Payment frequency and dates

- Total mandate duration

- How users can modify or cancel

2. Pre-Payment Notifications

While UPI AutoPay sends 24-hour advance notifications, consider sending additional reminders through email or in-app notifications to maintain user awareness and reduce surprise cancellations.

3. Flexible Subscription Options

Offer multiple subscription tiers and payment frequencies. Some users prefer monthly payments while others might opt for quarterly or annual subscriptions at discounted rates.

4. Graceful Failure Handling

When payments fail:

- Send immediate notifications explaining the failure reason

- Provide easy retry options

- Offer grace periods before service suspension

- Enable users to update their UPI details seamlessly

5. Easy Cancellation Process

Make subscription cancellation straightforward and hassle-free. Users who can cancel easily are more likely to subscribe in the first place, and they may return later if they had a positive experience.

6. Dashboard and Control

Provide subscribers with a comprehensive dashboard showing:

- Active mandates

- Payment history

- Upcoming payment dates

- Quick access to modify or pause subscriptions

7. Optimize for First Payment Success

The first payment after mandate creation is critical. Ensure clear instructions during onboarding and minimize friction in the initial authentication process.

User Experience Best Practices for Subscription Apps

Creating a seamless user experience is critical for subscription retention and growth. Here are essential UX best practices when implementing UPI AutoPay:

Onboarding Experience

Simplified Sign-Up Flow: Reduce friction by minimizing the number of steps required to create a subscription. For fintech apps, integrate KYC seamlessly into the onboarding process. For e-commerce platforms, allow users to start their subscription journey with minimal information and complete details later.

Clear Value Proposition: Before asking users to commit to a subscription, clearly articulate the benefits they’ll receive. Use visual elements, customer testimonials, and free trial options to build confidence.

Progressive Disclosure: Don’t overwhelm users with all payment details at once. Introduce mandate creation naturally after users have experienced value from your service.

Mandate Creation Interface

Visual Clarity: Design the mandate authorization screen with clear visual hierarchy. Highlight the subscription amount, frequency, and duration prominently. Use icons and color coding to make information scannable.

Trust Indicators: Display security badges, encryption information, and regulatory compliance indicators to build trust during the payment authorization process.

Real-Time Feedback: Provide immediate visual feedback when users complete each step. Show loading states, success confirmations, and clear error messages.

Mobile-First Design: Since most UPI transactions happen on mobile devices, ensure your subscription flow is optimized for small screens with touch-friendly buttons and readable text.

In-App Subscription Management

Centralized Dashboard: Create a single location where users can view all their subscription details, including active mandates, payment history, upcoming charges, and usage statistics.

Proactive Communication: Use in-app notifications, email, and SMS to keep users informed about upcoming payments, failed transactions, service changes, and renewal dates.

Pause and Resume Options: Instead of forcing users to cancel entirely, offer pause functionality that allows them to temporarily suspend their subscription and resume later.

Upgrade/Downgrade Flows: Make plan changes seamless. When users want to upgrade or downgrade, handle the mandate modification process automatically and communicate what will change clearly.

Payment Failure Recovery

Graceful Degradation: When payment fails, don’t immediately lock users out. Provide a grace period with clear communication about when service will be interrupted.

Multiple Recovery Paths: Offer alternative payment methods as backup options. Allow users to update their UPI ID, switch to a different UPI app, or use card payments temporarily.

Smart Retry Mechanism: Implement intelligent retry logic that attempts payment at different times during the allowed window, increasing the likelihood of success.

Transparency and Control

No Hidden Surprises: Always inform users before any price changes take effect. Require explicit consent for new pricing before creating a new mandate.

One-Click Cancellation: Make cancellation as easy as subscription creation. The easier it is to cancel, the more confident users feel about subscribing initially.

Feedback Loops: When users cancel, provide a simple feedback mechanism to understand why. Use this data to improve your service and potentially win back churning customers.

Accessibility Considerations

Screen Reader Support: Ensure all subscription management features are accessible to users relying on assistive technologies.

Language Localization: Support multiple Indian languages beyond English and Hindi, especially for e-commerce apps targeting tier-2 and tier-3 cities.

Offline-First Approach: For regions with inconsistent internet connectivity, design your app to cache subscription information and sync when connectivity is restored.

Measuring Success: Key Metrics to Track

For subscription businesses using UPI AutoPay, monitor these critical metrics:

- Mandate Creation Rate: Percentage of checkout attempts that result in successful mandate creation

- First Payment Success Rate: Success rate of the initial payment after mandate approval

- Recurring Payment Success Rate: Success rate of subsequent scheduled payments

- Mandate Revocation Rate: Percentage of active mandates canceled by users

- Payment Retry Success: Success rate of failed payment retries

- Customer Lifetime Value (LTV): Average revenue per subscriber over their entire subscription period

- Churn Rate: Percentage of subscribers who cancel within specific time periods

Conclusion

The UPI AutoPay feature rollout enables subscription businesses to access India’s 800+ million UPI users. Implementation requires technical integration with payment gateways (Razorpay, Cashfree, Paytm), regulatory compliance with RBI and NPCI guidelines, and user experience best practices.

For fintech apps (investments, lending, insurance) and e-commerce platforms (subscription boxes, content services), UPI AutoPay removes the credit card barrier. Successful implementation requires understanding how to integrate UPI AutoPay correctly, maintaining regulatory compliance, and following user experience best practices for subscription business models.

Need help integrating UPI AutoPay into your subscription app? Mindster specializes in building fintech and e-commerce solutions for the Indian market. Our team has hands-on experience implementing UPI AutoPay for subscription businesses, ensuring regulatory compliance, and creating seamless user experiences that drive retention. Contact Mindster to accelerate your subscription app development with proven technical expertise.

Professional content writer Akhila Mathai has over four years of experience. She writes posts about the different mobile app solutions we offer as well as services related to them. Her ability to conduct thorough research and think critically enables her to produce excellent, authentic, and legitimate content. Along with her strong communication abilities, she collaborates well with her teammates to create information that is current and relevant to emerging technology.